Takeaways

- Companies are likely to see continued pressure from both institutional investors and activists to separate businesses that are not deemed “core” and thereby generate higher equity multiples for the parent or the separated business.

- Tax-free spin-offs and similar transactions may be the most appealing way to separate a business, in part because companies retain flexibility during the process to change the structure of the transaction, and they can entertain third-party bids while pursuing a spin-off.

- Spin-offs are less dependent on third parties and market conditions, so the company has more control over the timing of a separation, which helps to unlock value on the company’s chosen timeframe.

In recent years, in the boardrooms of public companies with multi-line businesses, there have been few louder drum beats than those from investors calling for divestitures, spin-offs or other separation transactions aimed at increasing “corporate clarity.”

Separation transactions find their way onto board agendas at the behest of both long-term institutional investors searching for “pure play” opportunities and activist investors, who initiated seven proxy campaigns centered around corporate break-ups in the third quarter of 2022 alone.

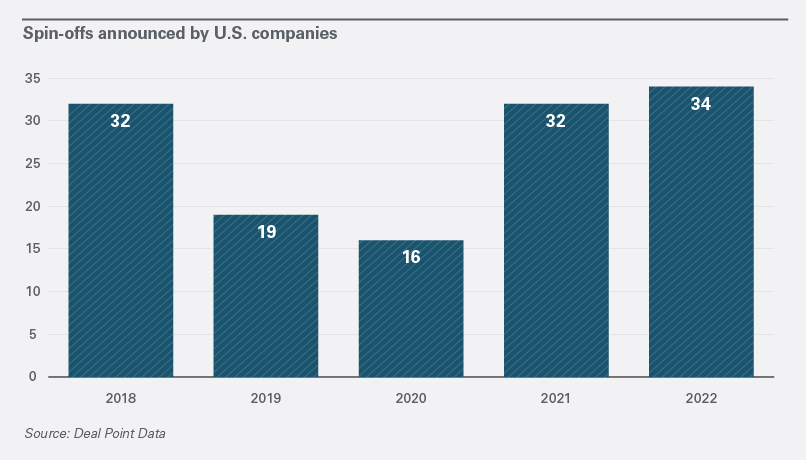

Against this backdrop, companies have responded with an increasing number of separation transactions, announcing $2.3 trillion of carve-outs globally in 2021 and more than 30 significant U.S. spin-off transactions in 2022.

As 2023 unfolds, boards and management can anticipate even more calls to “unlock value” by separation. One catalyst is the capital markets, where equity multiples generally have declined but growth sectors and businesses with predictable cashflows sometimes command premiums. Another factor is increased shareholder activism in response to the uncertain outlook for corporate performance due to macro-economic factors like higher interest rates, inflation and hampered demand.

As boards and management teams evaluate business portfolios and potential separation transactions, they confront an M&A environment in which carve-out sales face headwinds, including mismatches between buyer and seller valuation expectations, increased financing costs due to higher interest rates and market dislocation, uncertainty around the macro-economic outlook and increasingly aggressive regulatory reviews.

Faced with such an uncertain environment, boards and management teams contemplating separations would be well-advised to consider carefully spin-off and similar transactions like Morris Trusts, Reverse Morris Trusts, split-offs and incubator joint ventures — transactions we will refer to collectively as spin-offs. If well designed, these can not only unlock value for shareholders, but leave the company with flexibility regarding the final structure, so they can pivot along the way in response to input from shareholders or changing market conditions.

Why Pursue a Spin-Off Transaction to Unlock Value?

The Value Proposition

Board analysis of a spin-off, like any other proposed transaction, begins with the value proposition.

From a corporate growth perspective, spin-offs can improve returns by better aligning pay and performance for businesses leaders, providing equity currency for future transactions that is more closely linked to the characteristics of each business, and focusing management on improving organic business performance and growth. However, the upside must be weighed against one-time transaction costs and cost dis-synergies stemming from maintaining separate corporate infrastructures and loss of scale.

One of the chief advantages to the parent company of a spin-off, where a new public company is created around a business line or asset, is that the transaction does not entail any tax liability to the parent, as a straight sale to a buyer typically would. In situations where the parent’s tax basis in the separated business is low (and there would thus be a large taxable gain) but valuations are not robust enough to compensate for the tax burden, the tax-free nature of a spin-off alone may lead the parent to favor that form of transaction.

Moreover, the parent company may be able to bolster its balance sheet through a cash distribution to the parent before the spinoff (up to the level of its tax basis) and by issuing new debt of the spin-off company in exchange for existing debt owed by the parent.

Spin-offs offer similar tax advantages to parent shareholders, who receive valuable shares in a new public company without recognizing a taxable gain. In addition, when the equity markets attach a higher multiple to the new spin-off company, or the remaining parent company, because of a better growth profile or alignment with comparable companies, shareholders may see an immediate value uplift, as well as the potential for future gains through improved earnings growth or a later sale of the spun-off business.

At a time of market uncertainty, a spin-off represents an attractive way for a parent company to lock in value today but avoid the risk of selling “low” and missing out on the value accretion that may be available to its shareholders in the future.

Maximum Optionality to Control Timing and Pivot to a Third-Party Sale

Often boards and management teams analyzing a separation conclude that the business under consideration has its own life cycle that demands a break from the parent. Separation may be necessary to properly allocate capital for growth, to attract talent through management incentives, or to pave the way for growth through acquisitions. However, there may not be third-party interest at the time or current valuations may not be attractive.

Unlike a carve-out sale, boards can choose to announce a spin-off when the parent company and the separated business are ready, regardless of other market players. In our experience, when a spin-off can be consummated hinges mainly on the preparation of carve-out and pro forma financials for the securities registration statement, and on the board’s and management’s determination that the spin-off company’s growth and business case has been fully developed and will support a healthy market valuation. These are largely under the control (or at least the purview) of the parent.

Moreover, the board and management can continue to evaluate their course of action in response to changing circumstances after announcement of the spin-off. Indeed, frequently the information package provided in preliminary registration statement filings prompts interest from third-party buyers, who may not have been available when the transaction was initially considered. We believe that this may become even more common in 2023 as developments in the financing markets and other aspects of the M&A ecosystem unfold.

Importantly, a company that has announced plans for a spin-off can, with the proper tax advice, entertain indications of interest, and even engage in discussions with potential buyers. However, if a third party that participated in negotiations does not agree to a sale pre-spin and then buys the separated business after the spin-off, that can jeopardize the tax-free treatment in some circumstances, so caution must be exercised. Consideration should be given to pursuing any discussions as early as possible after spin-off announcement, both to minimize management distraction and to limit any restrictions on buyers after the spin-off.

Flexibility to Structure a Spin-Off in Response to Shareholder Input

While shareholders may help to catalyze the consideration of a spin-off, often a full understanding of shareholders’ preferences can only be gleaned after the spin-off has been publicly announced. But, again, the spin-off process allows boards and management to react to shareholder preferences regarding the scope of the business to be separated, capital structure and other attributes of the spin-off company after the preliminary registration statement is filed.

In fact, in our experience, it is increasingly common for companies to meet proactively with shareholders following announcement of a spin-off to solicit their input and assess how best to reflect that in the terms and structure of the transaction. In particular, when the business line under discussion is relatively distinct from the parent’s other businesses, some parent shareholders may not be eager to receive the spun-off company’s stock. In such cases, boards and managements should consider maintaining the option in registration statement filings to structure the separation as a split-off.

Unlike a spin-off, where all parent shareholders receive shares of the spun-off company pro rata, a split-off is structured as an exchange offer where each parent shareholder is given the choice to exchange some of its parent shares for the split-off company’s shares. This allows for a targeted distribution of the separated company’s shares to the parent shareholders who most desire to hold them, while delivering the benefits of a buyback of a portion of the parent company’s shares. In order to maximize shareholder choice, boards and management can obtain input from shareholders regarding their receptivity to a split-off after announcement of the separation.

Conclusion

In 2023, boards can expect to be called upon frequently to guide management teams as they consider separation transactions advocated by investors. Given the current dislocation in the macroeconomic environment and other sources of uncertainty, pursuing a spin-off may offer near-term advantages. A spin-off can deliver value without triggering tax, it does not require the participation of third parties, and can be less dependent on market conditions than a sale. Moreover, companies can tailor a transaction in response to shareholder input and alter course to capture value through a sale before consummation of the spin-off, or leave open the possibility that the newly independent business will be acquired after it is spun off.

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as

View other articles from this issue of The Informed Board

- How the New Proxy Rules Will Affect US Companies Facing Activist Campaigns

- European Activism: More Attacks, More Engagement, More ESG Coming in 2023

- FAQs: What the SEC’s New Insider Trading Rules Mean for Directors

- Multinationals Need To Revisit Their Reporting as New EU Sustainability Disclosure Rules Bite

- A Board Chair Explains How To Make the Most of Self-Evaluations

See all the editions of The Informed Board

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.