Takeaways

- The number of live activist campaigns in Europe grew again in 2022, and companies expect to see more in 2023, according to a survey conducted by Activistmonitor and Skadden.

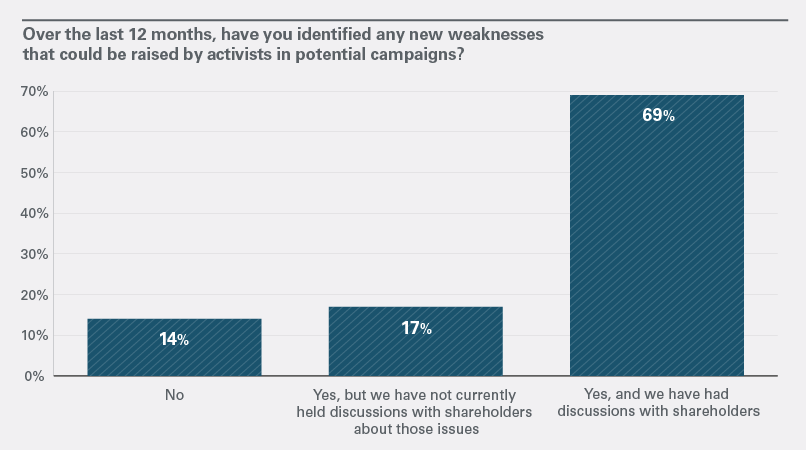

- Most companies surveyed have spotted weaknesses that could make them vulnerable to activists, and are addressing these.

- ESG issues increasingly figure in European activist campaigns, often alongside other more traditional themes such as governance matters, potential M&A transactions, share buybacks and other approaches to improving shareholder returns.

For the third year, Skadden’s European M&A practice has worked with Activistmonitor to survey executives from leading European companies and activist investors to assess their expectations for shareholder activism in Europe over the next 12 months. In this article we summarize the key findings.

Major themes we expect to see in 2023 based on the survey include:

- More campaigns: 86% of corporations identified new weaknesses that could be raised by activists.

- More engagement: 71% of the corporations responding anticipate an increase in shareholder activism and, of those, 48% expect a significant increase.

- More ESG: 96% of respondents expect that activists will increasingly prioritize ESG issues in their demands.

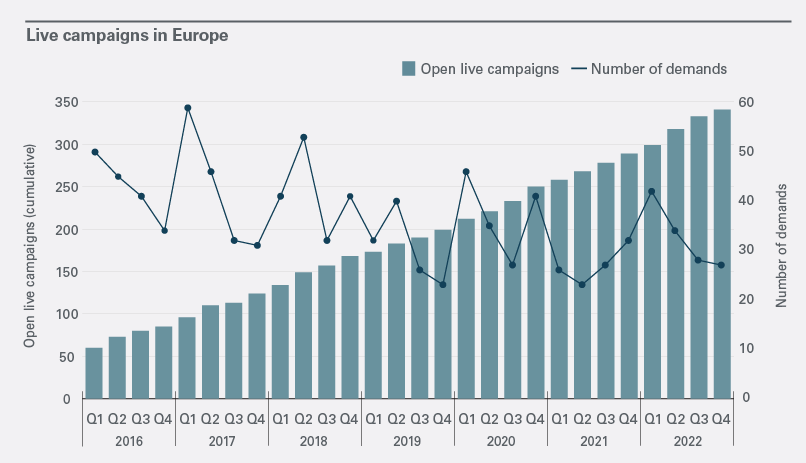

The number of open live campaigns in Europe steadily increased, reaching 341 in December 2022, including 52 campaigns launched in 2022. The largest number of new campaigns were in the United Kingdom (25), Germany (eight) and Switzerland (four).

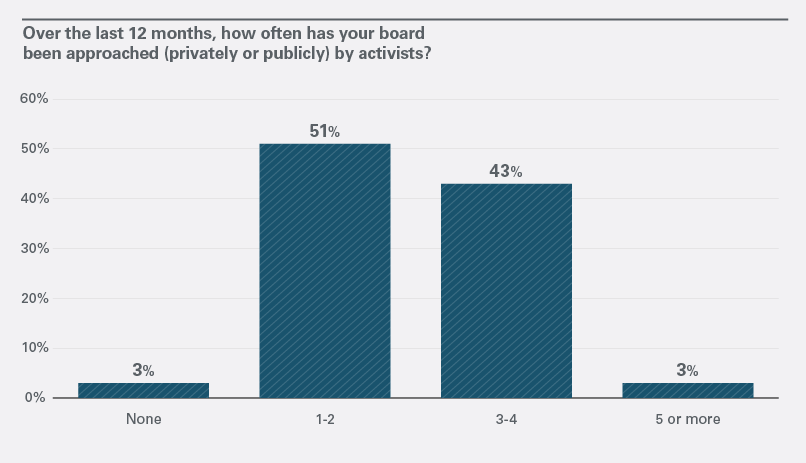

Many corporations have been approached by activists more than once in the past year — 46% at least three times.

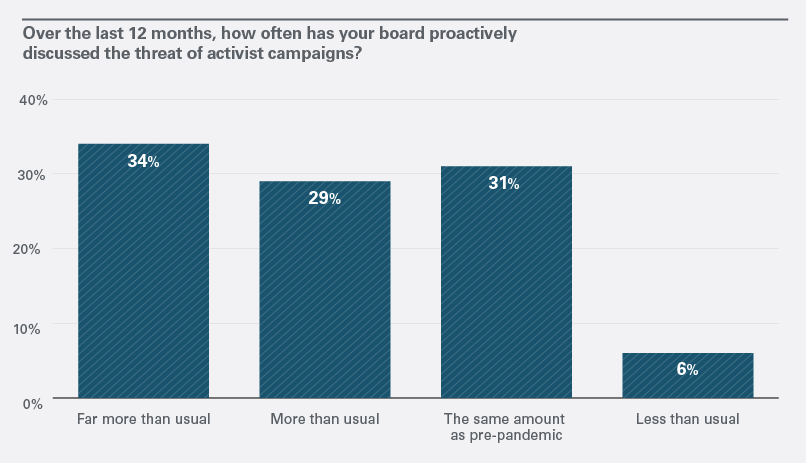

Board discussions of the threat of activist campaigns became more frequent in the past year, according to 63% of the responding corporations.

Corporations with a market capitalization exceeding $2 billion were much more likely to be targeted.

Total campaigns by market capitalization (live and potential)

| Market cap | 2021 | 2022 | Growth |

|---|---|---|---|

| <US$1bn | 16 | 17 | 6% |

| US$1bn-US$2bn | 5 | 5 | 0% |

| >US$2bn | 18 | 30 | 67% |

| Total | 39 | 52 | 33% |

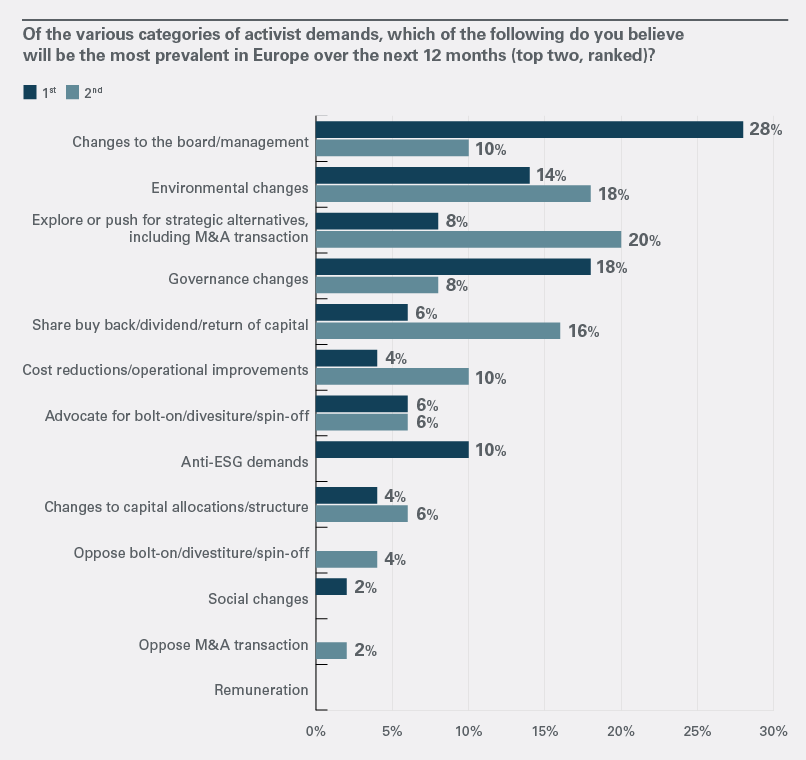

The types of demands made by activists continue to be varied, with particularly sharp increases in demands regarding cost reductions and operational improvements and demands opposing acquisitions and mergers.

Demands made in open live campaigns

| 2020 | 2022 | Growth | Y-o-Y 2022 | |

|---|---|---|---|---|

| Discussions | 7 | 0 | 2 | NA |

| Cost reductions/operational improvements | 14 | 5 | 18 | 260% |

| Share buy-back/dividend/return of capital | 9 | 8 | 4 | -50% |

| Acquisition/merger | 3 | 3 | 4 | 33% |

| Oppose acquisition/merger | 8 | 6 | 23 | 283% |

| Bolt-on/divestiture/spin-off | 13 | 14 | 9 | -36% |

| Oppose bolt-on/divestiture/spin-off | 1 | 4 | 0 | -100% |

| Strategic alternatives | 10 | 6 | 11 | 83% |

| Capital allocation/structure changes | 10 | 4 | 0 | -100% |

| Governance changes | 15 | 15 | 13 | -13% |

| Management/board changes | 16 | 17 | 26 | 53% |

| Board member(s) appointment | 22 | 18 | 15 | -17% |

| Environmental/social changes | 2 | 1 | 0 | -100% |

| Total | 130 | 101 | 125 | 24% |

Corporations are concerned about new weaknesses being identified and serving as the basis for attacks by activists.

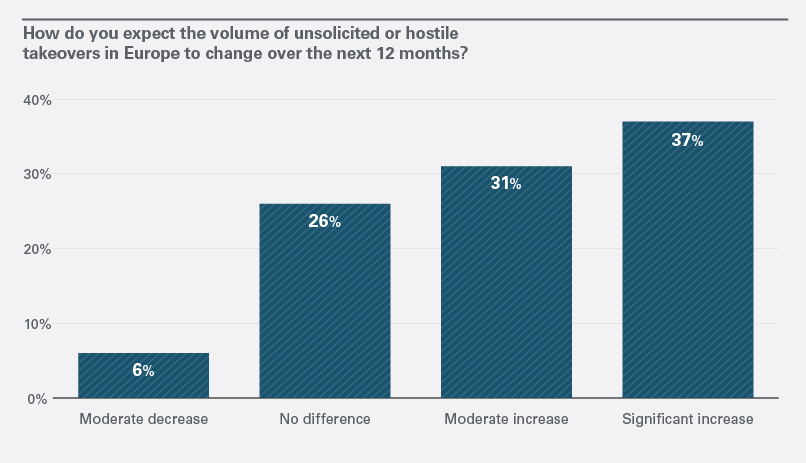

Increased activist activity is expected to lead to a greater number of unsolicited or hostile takeovers.

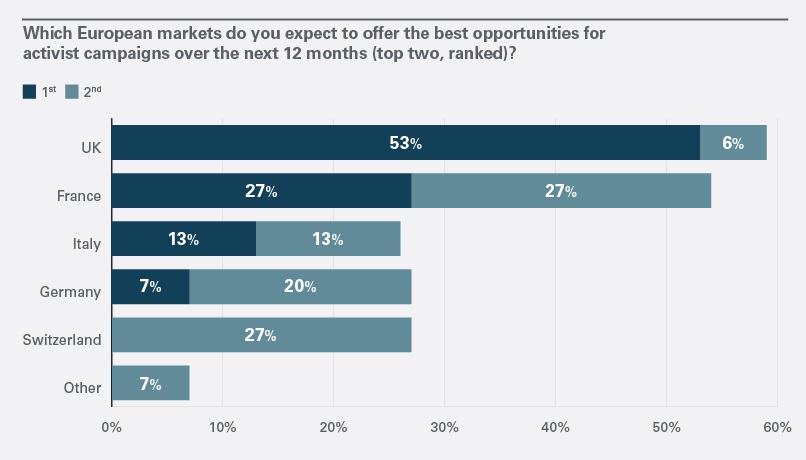

Attacks are expected to continue across Europe.

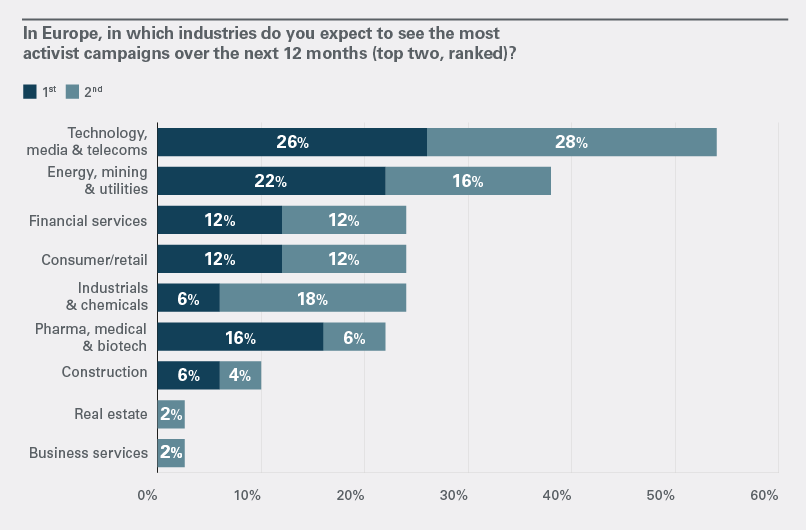

… and across a wide range of industry sectors.

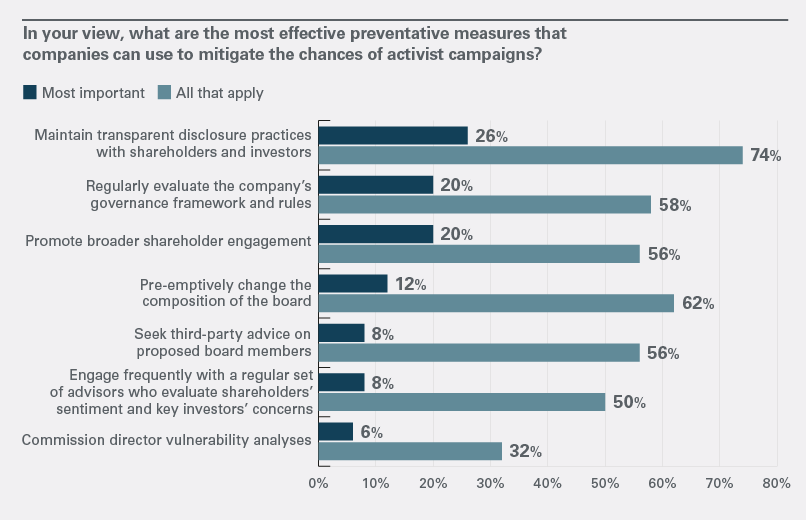

Given the level of attention, corporations expect to spend ever more time engaging with activists in the coming year.

Environment, social and governance issues are expected to figure prominently in activists’ demands in 2023.

View other articles from this issue of The Informed Board

- Putting the Best Spin on Corporate Splits

- How the New Proxy Rules Will Affect US Companies Facing Activist Campaigns

- FAQs: What the SEC’s New Insider Trading Rules Mean for Directors

- Multinationals Need To Revisit Their Reporting as New EU Sustainability Disclosure Rules Bite

- A Board Chair Explains How To Make the Most of Self-Evaluations

See all the editions of The Informed Board

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.