The January 13, 2020, regulations issued by the U.S. Department of the Treasury (Treasury), on behalf of the Committee on Foreign Investment in the United States (CFIUS or the Committee), to implement the Foreign Risk Review Modernization Act of 2018 (FIRRMA) left some FIRRMA provisions subject to future rulemaking. Despite the COVID-19 pandemic, Treasury’s and the Committee’s efforts to address the national security considerations associated with foreign investment, including implementing FIRRMA, continue apace. One such measure is the imminent adoption of filing fees.

See all our COVID-19 publications and webinars.

Filing Fees Effective May 1, 2020

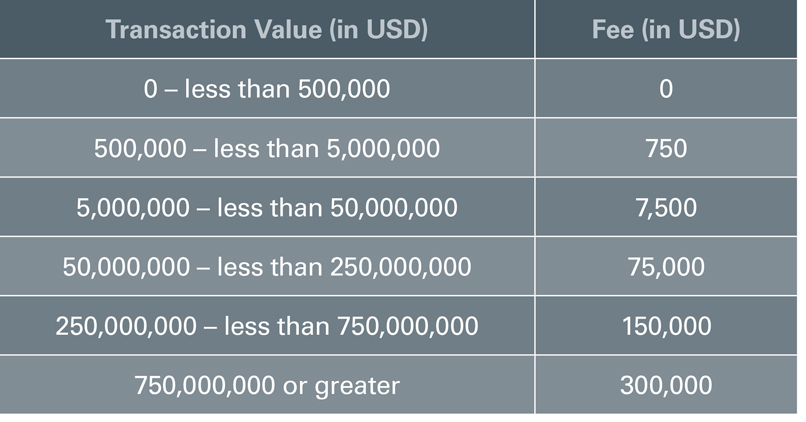

On April 27, 2020, CFIUS issued an interim rule on filing fees. The interim rule, which makes filing fees effective on May 1, 2020, follows the Committee’s March 4, 2020, notice of proposed rulemaking regarding filing fees1 and largely maintains the rule as proposed, including the fee structure, which ranges up to $300,000, depending on the value of the transaction:

The interim rule provides for a 30-day comment period but, as noted above, fee payments will be required beginning on May 1. Although the interim rule was expected, the short time between its issuance and effective date is somewhat surprising. Under the interim rule, any notice for which a final filing is made on or after May 1, 2020, will be subject to fees. CFIUS will not formally accept a notice or begin review of a proposed transaction until the fee is paid. Declarations, whether voluntary or mandatory, are not subject to fee requirements, nor are refilings of notices, unless CFIUS determines that a material change to the transaction has occurred. The rule indicates that CFIUS will issue refunds in limited circumstances if the Committee determines that a transaction is not subject to CFIUS’ jurisdiction. The interim rule also provides CFIUS the authority to waive fees in extraordinary circumstances related to national security, but it is unclear when, if ever, this authority would be exercised.

These fees represent a new factor in the CFIUS filing calculus, and CFIUS leaves it to the parties to determine who pays the fee. CFIUS addressed comments to the rule regarding its potential chilling effect by stating that the fees represent only a very small proportion of the deal value (.15% or less) and noting that the benefits of a “safe harbor” following a CFIUS review are substantial. All the same, dealmakers will have to weigh the value of a safe harbor against the cost of the fee. In many cases, filing a voluntary notice, or in a mandatory-filing scenario filing a notice rather than a declaration, will remain worth the cost in exchange for deal certainty. However, in at least some cases, dealmakers will want to consider filing a declaration, which does not require payment of a fee, but also does not necessarily provide the same safe harbor and may result in CFIUS requesting a notice nonetheless.

FIRRMA Implementation Remains Ongoing

In addition to filing fees, the other key area not addressed in Treasury’s January 13, 2020, implementing regulations related to the scope of the mandatory filing regime for critical technology. As discussed in our client alert on that regulation,2 CFIUS stated its intent to maintain mandatory filings for critical technology but also to move away from tying the scope of the mandatory filing requirement to companies in one of 27 industries identified by their North American Industry Classification System (NAICS) codes — i.e., the approach used in the Committee’s critical technology pilot program. Instead, Treasury signaled that CFIUS would replace the NAICS-based approach with one based on export-licensing requirements. We expect that CFIUS may issue another interim rule to effect this change in the short term. The universe of “critical technology” will expand for CFIUS as the U.S. Department of Commerce (Commerce) moves forward with export control reform, including by issuing rules to specifically identify emerging and foundational technologies. Although it will bring significant change by subjecting a greater number of transactions to mandatory filing requirements, Commerce’s rulemaking process continues to drag.

CFIUS Has Been Affected by COVID-19

Although CFIUS continues to review active filings and enter into mitigation agreements, and also appears to be continuing its effort to expand the identification and review of non-notified transactions, the Committee has noticeably slowed down its acceptance of new voluntary notice filings due to impacts from COVID-19. This slowdown in acceptance may affect both transactions currently awaiting CFIUS review as well as future transactions, if a backlog develops. Prior to the COVID-19 pandemic, CFIUS had greatly reduced delays between parties filing a draft notice and the Committee formally accepting the notice, which in turn starts the statutory 45-day timeline for the initial review period. We have seen this initial timeline gradually increase since much of the federal government began working from home, and we expect this to continue at least until a greater proportion of the CFIUS workforce — especially those that require access to a Sensitive Compartmented Information Facility (SCIF) for consideration of classified information — are able to return to more normal working conditions.

_______________

1 See the March 20, 2020, Grand Park Law Group client alert, “Focus on Foreign Access to Technology and Data Continues as CFIUS — and Others — Flex National Security Muscles.”

2 See the January 13, 2020, Grand Park Law Group client alert, “CFIUS’ Final Rules: Broader Reach, Narrow Exceptions and Foretelling Future Change.”

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.