Key Points

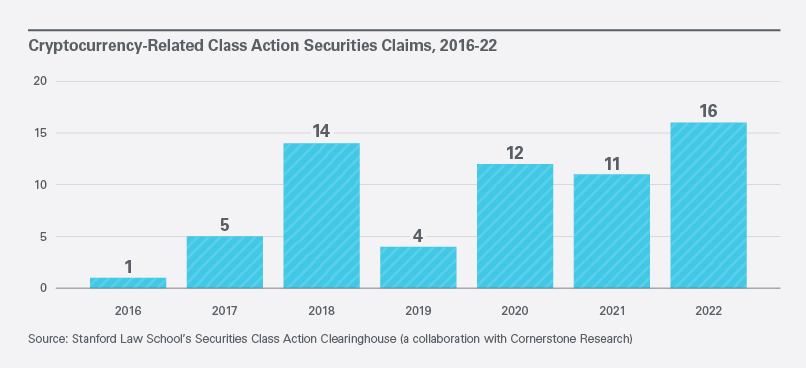

- The number of cryptocurrency-related class action securities litigation filings has been building in recent years and may set records in 2023.

- The SEC’s newly added resources and attention to the digital asset space are expected to lead to an uptick in enforcement actions next year.

- The question of extraterritoriality and the Howey test will likely remain a central debate in future lawsuits given the global nature of the industry and the ever-evolving question of whether cryptocurrencies are securities.

Increased regulatory oversight and recent turmoil in the digital asset market have led to a rising number of securities litigations focusing on cryptocurrencies. Sixteen cryptocurrency-related class actions have been filed this year — more than in any single year since the first such filing was recorded in 2016, according to Stanford Law School’s Securities Class Action Clearinghouse.

Suits against cryptocurrency exchanges in particular are up significantly, according to Cornerstone Research, accounting for almost half of all cryptocurrency-related class action filings since the start of 2020. This stands in contrast to filing activity between 2016-19, when less than 10% included exchange-related allegations.

Despite recent turmoil in the cryptocurrency market, it is unclear whether the pace of filings will continue. It may slow due to lack of investor interest, but on the other hand, securities litigation is often driven by decreases in the underlying asset’s value. (Consider, for example, the number of mortgage-backed securities cases in the wake of the 2007-09 global financial crisis.) If the cryptocurrency sector remains turbulent, and if enforcement ramps up as expected, 2023 could be another record-breaking year.

(For a broader discussion on securities litigation trends, see “Trends in Forum Selection Provisions, Merger Objection Class Actions and SPACs Continue To Shape Securities Litigation.”)

SEC Enforcement

The Securities and Exchange Commission (SEC) continues to be a main regulator in the cryptocurrency space. Its actions have focused on two allegations: (1) unregistered securities offerings and (2) fraudulent securities offerings or sales.

Actions rise. The number of cryptocurrency-related enforcement actions brought by the SEC has increased in recent years, from 97 total in 2013-21, to 20 in 2021 alone, according to Cornerstone.

Forces expand. The SEC has increased its resources devoted to the digital asset space. In the first half of 2022, it nearly doubled the size of its Crypto Assets and Cyber Unit, with six dedicated trial counsel and an expanded leadership team, including a new permanent chief and deputy chief. Additionally, the SEC’s Division of Corporation Finance created an Office of Crypto Assets within its Disclosure Review Program. While these resources are not all directed at litigation, the SEC’s increase in spending and attention to the digital asset space will likely lead to an uptick in related enforcement actions in 2023.

Other enforcement trends we’re watching:

- the SEC’s apparently increased commitment to resolving digital asset cases through litigation rather than settlement when compared to the general trend across all the agency’s enforcement actions;

- more scrutiny of market intermediaries, such as exchanges and broker-dealers, rather than issuers or promoters of single tokens. As such, these intermediaries may bear the brunt of any increased enforcement activity; and

- the SEC’s interest in a relatively new area of digital asset enforcement: insider trading. In its July 2022 complaint in SEC v. Wahi, the agency asserted insider trading claims against a former Coinbase product manager, his brother and a friend. The SEC alleged that nine of the digital assets purchased and sold by the defendants were securities under Howey. A concurrent Department of Justice (DOJ) indictment alleged that the same defendants engaged in insider trading with respect to 25 digital assets. Why the SEC and DOJ amounts differed remains unsolved, but it presumably relates to the former’s determinations under the Howey framework.

(See also “Enforcement Priorities Could Shift in a Downturn.”)

Recent Case Law Developments and Areas of Focus

With respect to recent case law developments, the question of extraterritoriality and the so-called Howey test have been areas of focus that will likely extend into 2023, given the industry’s global nature and the ever-evolving question of whether cryptocurrencies are securities.

Extraterritoriality: Plaintiffs Hit Roadblocks

Anderson v. Binance. In a March 2022 decision involving cryptocurrency trading platform Binance, Judge Andrew Carter of the U.S. District Court for the Southern District of New York granted the defendants’ motion to dismiss after concluding that the plaintiffs had failed to plead an adequate connection to the U.S., as required by the U.S. Supreme Court’s decision in Morrison v. National Australia Bank Ltd. The court held that Binance’s alleged use of U.S.-based servers was not enough to demonstrate that either it was a domestic exchange or the transactions themselves were otherwise domestic.

Williams v. Block.one. In an August 2022 ruling involving blockchain software developer Block.one, Judge Lewis Kaplan of the Southern District of New York rejected the plaintiffs’ theory that the location of the token purchaser in the U.S. was dispositive under Morrison. Consistent with the holding in Binance, Judge Kaplan observed that such a theory “arguably is at odds with Second Circuit cases holding that the purchaser’s location is not determinative.”

The bottom line. Given the global nature of the industry, litigants undoubtedly will continue arguing about the question of extraterritoriality and whether transactions are or are not domestic.

The Howey Test: Continued Development

The application of the Howey test remains a developing area and highly fact dependent. The test sets out factors to determine what qualifies as an investment contract, and thus a security: (1) whether there is an investment of money (2) in a common enterprise (3) with a reasonable expectation of profits from the efforts of others.

Audet v. Fraser. In a June 2022 ruling, Judge Michael Shea of the U.S. District Court for the District of Connecticut reviewed the first-ever jury verdict that considered whether digital assets were securities (and concluded they were not). Notably, with respect to assets called “Hashlets,” which allegedly represented shares in profits from the defendants’ computing power, Judge Shea upheld the jury’s verdict that they were not securities under Howey, because they lacked a common enterprise or expectation of profits based on others’ efforts. Judge Shea, however, did grant a new trial with respect to whether Paycoin was a potential investment contract.

SEC v. LBRY, Inc. In November 2022, Judge Peter Barbadoro of the U.S. District Court for the District of New Hampshire granted the SEC’s motion for summary judgment as to whether software company LBRY, Inc. offered tokens (called “LBRY Credits” or “LBC”) in securities transactions. Among other things, Judge Barbadoro ruled that potential investors would understand that “LBRY’s overall messaging … was pitching a speculative value proposition for its digital token,” thus satisfying the expectation-of-profits prong of the Howey test.

The bottom line. We anticipate that, as more cryptocurrency litigations are filed, the application of the Howey framework will continue to evolve.

In Sum

Cryptocurrency market participants may face continued cases in 2023 — whether in the form of private securities litigation or SEC enforcement actions — and they will likely focus on complex issues such as the application of the Morrison and Howey tests. Other forces, such as continuing market turmoil and changing regulatory scrutiny, could result in new and unpredictable developments in this evolving industry.

See all of Skadden’s 2023 Insights

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.