Part IV: DOE Loan Programs (Innovative Energy Technologies and Advanced Technology Vehicle Manufacturing)

In the final installment of our four-part series on the Infrastructure Investment and Jobs Act (IIJA), we focus on the Department of Energy (DOE) Loan Programs Office (LPO), which administers loan guarantee and direct loan programs supporting innovative clean energy, tribal energy, and advanced technology vehicle manufacturing (ATVM).

We also discuss provisions in the recently enacted Inflation Reduction Act (IRA), which also includes significant funding for, and statutory amendments relating to, the DOE LPO.

Carbon Dioxide Transportation Infrastructure Finance and Innovation (CIFIA) Program

The secretary of energy is directed to establish a $2.1 billion federal credit program to provide loans and loan guarantees for common carrier carbon dioxide transportation infrastructure or associated equipment (including pipelines, shipping, rail or other transportation infrastructure and associated equipment) that will transport or handle carbon dioxide captured from anthropogenic sources or ambient air. The IIJA authorizes $600 million for the CIFIA program for each of federal fiscal years 2022 and 2023 and $300 million for each of federal fiscal years 2024 through 2026 (which is available until expended). Like other federal credit programs, the authorized funding amount corresponds to the amount available to pay credit subsidy costs, which are similar in purpose to loan loss reserves. Actual lending capacity will be closer to $20 billion.

Applicants (either public or private sector entities) must submit a letter of interest to the secretary of energy prior to submitting an application. Projects must constitute common carrier infrastructure for carbon dioxide transportation and must have eligible project costs that are reasonably anticipated to be at least $100 million. The amount of a secured loan shall not exceed an amount equal to 80% of eligible project costs, but in practice, the leverage may be lower, depending on the creditworthiness of the project.

Unlike the TIFIA and WIFIA programs for transportation and water infrastructure projects, respectively, there is no requirement that either the federal credit instrument or the senior project debt obtain an investment-grade rating. The secretary of energy will determine the creditworthiness of each project and obligor, and whether a reasonable prospect of repayment of the principal and interest exists, using the same criteria established for the DOE’s Title XVII programs. Similar to TIFIA and WIFIA, public sector entities may submit applications under which a to-be-identified public-private partnership (P3) preferred bidder will be the obligor under the federal credit instrument. CIFIA loans and loan guarantees are to be repaid in whole or in part from user fees, payments owing to the obligor under a P3 or other revenue sources that also secure or fund the project’s other debt obligations.

Implementation Efforts: Since passage of the IIJA, the DOE’s Office of Fossil Energy and Carbon Management (FECM) and LPO have been undertaking stakeholder outreach, coordinating with other federal agencies, and developing guidance documents and online resources for applicants. The DOE LPO’s objective is to begin receiving letters of interest from applicants in October 2022, and it is expected to issue a notice of funding opportunity (NOFO) in the fourth quarter of 2022.

Funding for Existing DOE LPO Programs

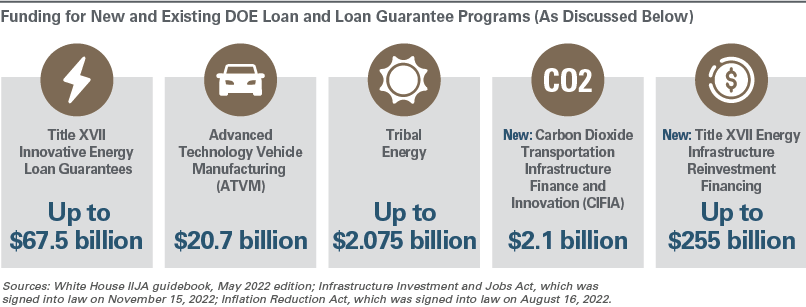

The IIJA authorizes new funding for several of the DOE’s existing loan and loan guarantee programs.

Title XVII Innovative Energy Loan Guarantees. The IIJA authorizes the following loan guarantees: $8.5 billion for advanced fossil energy projects, $10.9 billion for advanced nuclear energy projects and up to $4.5 billion in loan guarantees for renewable energy and efficient energy projects.1 The IRA authorizes new Title XVII authority of up to $40 billion for DOE loan guarantees under Section 1703 of the Energy Policy Act of 2005 (available through September 30, 2026), with $3.6 billion set aside to cover the credit subsidy cost of such loan guarantees.

ATVM. The IIJA authorizes $17.7 billion for direct loans for the ATVM solicitation.2 The IRA authorizes $3 billion to cover the credit subsidy costs of the ATVM loans (available through September 30, 2028). In addition, there is the elimination of the $25 billion ATVM loan authority cap.

Tribal energy. The IIJA authorizes up to $2 billion in partial loan guarantees for the Tribal Energy solicitation. The IRA authorizes $75 million to cover the credit subsidy costs of the Tribal Energy Loan Guarantee Program (TELGP) (available through September 30, 2028). In addition, the TELGP loan authority cap was increased from $2 billion to $20 billion.

Amendments to Title XVII Innovative Energy Loan Guarantee and ATVM Programs

Energy Infrastructure Reinvestment Financing. The IRA amends the Energy Policy Act to add new Section 1706 and establish thereunder a new Title XVII DOE loan guarantee program to finance energy infrastructure reinvestment. The IRA appropriates up to $250 billion in funding authority under new Section 1706 (available through September 30, 2026), with $5 billion for activities under the new program. The new program will finance projects that (i) retool, repower, repurpose or replace energy infrastructure that has ceased operations or (ii) enable operating energy infrastructure to avoid, reduce, utilize or sequester air pollutants or anthropogenic emissions of greenhouse gases. The scope of Section 1706 is broad and appears to be available to support brownfield redevelopment or new emissions control technologies for virtually any type of energy facility, whether related to oil and gas, coal, nuclear, other electric generation or mining.

Reasonable prospect of repayment. The IIJA amends the Energy Policy Act to expand and elaborate the criteria that the DOE uses to determine whether an applicant has demonstrated a reasonable prospect of repayment of a loan guaranteed under a Title XVII loan guarantee program. The criteria include (i) the strength of the contractual terms of the eligible project (if commercially reasonably available), (ii) the forecast of noncontractual cash flows supported by market projections from reputable sources, as determined by the secretary of energy, (iii) cash sweeps and other structure enhancements, (iv) the projected financial strength of the borrower at the time of loan close and throughout the loan term after the project is completed, (v) the financial strength of the borrower’s investors and strategic partners, if applicable, and (vi) other financial metrics and analyses that the private lending community and nationally recognized credit rating agencies rely on, as determined appropriate by the secretary of energy.

Critical materials. The IIJA amends the Energy Policy Act to expand the list of projects eligible to receive a DOE loan or loan guarantee to include projects that increase the domestically produced supply of critical minerals (essential for electric vehicles, or EVs), including through the production, processing, manufacturing, recycling or fabrication of mineral alternatives. Funding and commitments authorized prior to passage of the IIJA are not available for critical materials projects, but funding authorized under the IIJA and in the future may be used to finance these projects.

ATVM. The IIJA amends the Energy Independence and Security Act of 2007 to expand the eligible vehicle types to receive loans under the ATVM Program. These include medium- or heavy-duty vehicles that exceed 125% of existing greenhouse gas emissions and fuel efficiency standards, trains or locomotives, maritime vessels, aircraft, and hyperloop technology. Amounts appropriated to the program prior to passage of the IIJA are not available for the wider set of vehicles introduced in the IIJA amendment, but funding authorized under the IIJA and in the future may be used to finance these projects. This section introduces the same criteria for determining whether a reasonable prospect of repayment of the loan exists as applies to other Title XVII credit support. The IIJA also stipulates, without elaboration, that ATVM Program loans cannot be subordinate to other financing.

State energy financing institutions. The IIJA defines state energy financing institutions (quasi-independent entities or entities within a state agency or financing authority established by a state for defined purposes) and provides that loan guarantees can be made available to projects supported by a state energy financing institution. These projects must demonstrate that they avoid, reduce or sequester air pollutants or anthropogenic emissions of greenhouse gases, but they do not need to employ new or significantly improved technologies. The intent of this amendment is to enable the DOE to provide loan guarantees to state energy financing institutions that provide financing support or credit enhancements for eligible projects and that (i) create liquid markets for eligible projects, including through warehousing and securitization, or (ii) take other steps to reduce financial barriers to the deployment of existing and new eligible projects. State energy financing institutions could foreseeably play a role similar to state financing authorities that administer State Revolving Funds, which issue bonds secured by pools of loans to local drinking water and wastewater projects. A number of these state financing authorities have received WIFIA loans from the Environmental Protection Agency (EPA).

Conflicts of interest. The IIJA adds a new requirement for any loan or loan guarantee that the secretary of energy must certify that political influence did not impact the selection of the project. This provision is likely a response to allegations that a loan guarantee provided to now-dissolved solar equipment manufacturer Solyndra resulted from political influence.

Limitations. The IRA introduces new limitations for Section 1703 loan guarantees:

Certification: No funding will be made available from the newly authorized funds under the IRA for any project unless the president has certified in advance and in writing that the applicable loan guarantee and project comply with specific requirements under the IRA. This certification is likely intended to address the “no double-dipping” limitation described below, but it is unclear when this certification would be provided in the context of a particular transaction. It is also unclear whether and to whom the president will delegate the certification responsibility.

Denial of double benefit (no double-dipping): No funding will be made available for commitments to guarantee loans for any projects under which federal funds, personnel or property are expected to be used (directly or indirectly). Exceptions are given for those projects that benefit from (i) federal tax benefits (such as tax credits) or (ii) being located on federal land pursuant to a lease or right-of-way agreement whereby consideration is paid in cash, deposited in the U.S. Treasury as offsetting receipts and equal to the fair market value, or from (iii) electric generation projects using transmission facilities owned or operated by a Federal Power Marketing Administration or the Tennessee Valley Authority that have been authorized, approved and financed independent of the project receiving the loan guarantee. This provision could pose a challenge for a Title XVII DOE loan guarantee applicant if it has previously received support from the DOE for demonstration projects or technology developments that were related to or incorporated into the project for which the applicant is seeking the loan guarantee.

Eligible Lender Loan Guarantees. The IRA amends the Energy Policy Act to allow the DOE to guarantee a loan from any “Eligible Lender” (including commercial banks and other private sector lenders) for any project that is eligible to receive a Title XVII loan guarantee, including projects eligible under the newly created Section 1706 loan guarantee program.

Source of payments. The IRA amends the Energy Policy Act to provide that the borrower under a Title XVII loan guarantee is not allowed to use proceeds of a loan or other debt obligation that is made or guaranteed by the federal government to pay the credit subsidy cost for such Title XVII loan guarantee.

* * *

Takeaways

Based on the DOE LPO’s portfolio performance summary as of June 30, 2022, the DOE LPO has underwritten more than $36 billion of loans and loan guarantees. The IIJA and IRA together substantially increase the DOE LPO’s funding capacity and include amendments to the authorizing statutes that (i) expand the list of entities eligible to receive loan guarantees to include state energy financing institutions; (ii) expand the list of eligible projects to cover those that enhance the availability of critical materials for energy storage systems; that expand manufacturing of emissions-efficient medium- or heavy-duty vehicles, trains, locomotives, maritime vessels, aircraft and hyperloop technology; and that retool, repower, repurpose or replace energy infrastructure that has ceased operations or that enable operating energy infrastructure to avoid, reduce, utilize or sequester air pollutants or anthropogenic emissions of greenhouse gases; (iii) clarify the criteria for demonstrating a reasonable prospect of repayment and place restrictions on utilizing Title XVII financings in addition to other federal support and on using federal financing to pay credit subsidy costs; and (iv) reduce transaction costs by appropriating significant amounts to cover credit subsidy costs and eliminating upfront application fees for Title XVII loan guarantees.

With approximately $334 billion in new loan and loan guarantee authority under the IIJA and the IRA, we anticipate that the DOE LPO will be very active in the coming years. Project sponsors in areas supported by the DOE LPO should devote time to determine whether and how financial support from the DOE LPO may benefit them. There is no question that for well-structured projects, with strong contractual arrangements for construction, supply, offtake and operations, the DOE LPO can provide long-term, low-interest financing that is generally not available from commercial lenders.

In this series, we have explored a wide variety of important programs that, once fully launched either later this year or in 2023, should facilitate significant advancement of U.S. infrastructure across a broad spectrum and open up investment opportunities for private sector participants in these industry segments. Paired with the federal investments in renewable energy, climate change and domestic manufacturing included in the IRA, the IIJA represents a watershed moment in U.S. infrastructure investment.

Realizing the potential benefits of the IIJA will require an incredible amount of work among stakeholders in the years to come. That work is critical given the challenges posed by climate change and the need to stitch together areas of consensus in the current fractured domestic political landscape.

_______________

1 On June 8, 2022, the DOE LPO announced that it had closed on a $505.4 million loan guarantee for construction of the Advanced Clean Energy Storage (ACES) clean hydrogen storage project in Utah. This is the first loan guarantee for a new clean energy technology project from the DOE LPO since 2014.

2 On July 27, 2022, the DOE LPO announced that it had closed on a $101.2 million loan to Syrah Technologies for the expansion of the Syrah Vidalia Facility in Louisiana, which will produce a critical mineral used in lithium-ion batteries for electric vehicles and other clean energy technologies. This is the first ATVM loan closing since 2011.

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.