This update provides an overview of key regulatory developments in the past three months relevant to companies listed or planning to list on The Stock Exchange of Hong Kong Limited (HKEx) and to their advisers. In particular, it covers amendments to the Rules Governing the Listing of Securities on HKEx (Listing Rules) as well as announcements, guidance and enforcement-related news from HKEx and the Securities and Futures Commission (SFC). Other recent market developments may also be included. We do not intend to cover all updates that may be relevant, but we welcome feedback, so please contact us if you would like to see analysis of other topics in the future.

- HKEx Issues Consultation Conclusions on Proposed Amendments to Listing Rules Relating to Share Schemes of Listed Issuers

- HKEx Publishes Revised FAQ on Book-Building and Placing Activities

- HKEx Publishes Listing Decision on Unsuitable WVR Listing Applicant Suitability

- HKEx Publishes Guidance on Good Record-Keeping

- Takeovers Panel Rules a Special Waiver From the General Offer Obligation May Be Granted for an Involuntary Disposal That Leads to a Change in Concert Group Leader

- Takeovers and Mergers Panel Rules on Appropriate Price for Mandatory General Offer

- Enforcement Matters

HKEx Issues Consultation Conclusions on Proposed Amendments to Listing Rules Relating to Share Schemes of Listed Issuers

Following HKEx’s consultation paper on listed companies’ share incentive schemes (covered in our February 2022 Hong Kong Regulatory Update, HKEx has announced its consultation conclusions, which amends the rules for share option schemes contained in Chapter 17 of the Listing Rules, effective starting 1 January 2023.

The amended rules extend the scope of regulation for share option schemes to encompass share award schemes (including share grants, restricted share units and other similar share incentives) (collectively, share schemes), which will now be regulated under the same set of rules as share option schemes. The rules also apply to share schemes implemented through trusts or other similar holding vehicles.

Other key new requirements under the amended rules include the following:

- Eligible participants: Companies may only grant awards to three categories of eligible participants under a share scheme:

- employee participants — directors and employees of the issuer or any of its subsidiaries;

- related entity participants — directors and employees of the holding companies, fellow subsidiaries or associated companies of the issuer; and

- service providers — persons who provide services to the issuer group on a continuing and recurring basis in its ordinary and usual course of business that are in the interests of the long-term growth of the issuer group.

- Scheme mandate limits: The total number of shares that may be issued across all options and awards to be granted under all of a company’s share schemes in aggregate must not exceed 10% of the relevant class of shares in issue. This limit may be “refreshed” (i.e., awards already granted under the share scheme disregarded and the counter reset for the purposes of calculating the limit) with shareholders’ approval once every three years or with independent shareholders’ approval if refreshed within a three-year period. A separate sublimit must be set for grants to service providers.

- Limits on individual grants: Independent shareholders must approve grants to a single participant that exceed 1% of shares on issue over any 12-month period.

- Exemptions from connected transaction restrictions for grants to directors: Grants of share options to directors (other than independent nonexecutive directors (INEDs)) are fully exempt from the regulation’s limits, while a grant of share awards to any such directors requires independent shareholders’ approval if it exceeds 0.1% of shares on issue over any 12-month period. For INEDs or substantial shareholders, the 0.1% limit applies to grants of both share options and share awards.

- Vesting period: Generally grants must be subject to a minimum vesting period of not less than 12 months, except for grants to employee participants that may be subject to a shorter vesting period in certain narrowly defined circumstances.

- Performance targets and clawback mechanisms: HKEx expects issuers to provide performance targets for awards and to implement a clawback mechanism to recover awards to grantees who engage in misconduct. If such features are not implemented, a negative statement to that effect must be contained in the scheme document together with a reasoned explanation from the board.

- Limited waivers for transfer of awards: While share awards or options generally may not be transferred or assigned, HKEx may grant a waiver to allow transfers to a vehicle (such as a trust or a private company) for the benefit of the participant or their family members for estate or tax planning purposes.

- No voting of unvested shares: A trustee holding unvested shares of a share scheme must abstain from voting those shares on matters that require shareholders’ approval under the Listing Rules, unless otherwise required by the law to vote in accordance with the direction of the beneficiary.

- Disclosure of grants: Companies must disclose details of grants of share options or share awards and on a named individual basis for grants to directors, chief executives, substantial shareholders or their associates, as well as for any grant in excess of the 1% individual limit (or 0.1% for related entity participants or service providers).

- Share schemes funded by existing shares: A company must disclose information regarding share schemes funded by existing shares on a similar basis to how the company reports on schemes funded by new shares.

- Subsidiaries’ Share Schemes: Share schemes of a listed issuer’s principal subsidiaries (defined as a subsidiary for which the revenue, profits or total assets accounted for 75% or more of those the issuer recorded in any of the latest three financial years) shall be subject to the same requirements as schemes of the listed issuer. Share schemes of other subsidiaries will be governed by the usual rules on disclosable transactions in Chapter 14 and connected transactions under Chapter 14A of the Listing Rules.

Under transitional arrangements, after 1 January 2023, issuers can continue to make grants under their existing schemes until refreshment or expiry of the existing scheme mandate (upon which the issuer would be required to amend the terms of the scheme to comply with the new Chapter 17 and seek shareholders’ approval for a new scheme mandate). However, such grants must only be made to persons who qualify as “eligible participants,” as described above, under the new rules.

Listing applicants may choose to comply with the new rules for their share schemes or continue to make grants to “eligible participants” (as described above) under existing schemes until refreshment or expiry of the existing scheme mandate, or until the second annual general meeting after 2023 for share award scheme using general mandate. At that point, the issuer must amend the terms of the scheme to comply with the new Chapter 17 requirements.

HKEx Publishes Revised FAQ on Book-Building and Placing Activities

HKEx has updated its frequently asked questions regarding the recently implemented requirements on book-building and placing activities under the Code of Conduct for Persons Licensed by or Registered With the SFC (covered in our August 2022 Hong Kong Regulatory Update), which came into effect on 5 August 2022. Highlights include the following:

- The appointment of a sponsor-overall coordinator (sponsor-OC) must be made under a written engagement agreement at least two months before the A1 submission (or refiling), and at the same time the engagement agreement must specify the fixed fee arrangements of that sponsor-OC. Fixing the fee arrangements at a later date, after entering into the engagement letter but before issuing the OC announcement two weeks after the A1 submission (or refiling), is inconsistent with the new code provisions.

- HKEx interprets “fixed fee” as the minimum amount of fee a capital market intermediary (CMI) is entitled to, which is not subject to the issuer’s later discretion. For a fee to be regarded as a fixed fee, the engagement letter must indicate both the fee entitlement and the identity of the payee CMI. If the engagement letter specifies a fixed percentage of gross proceeds to all overall coordinators (OCs) but the actual allocation to each OC is to be determined at the issuer’s discretion, these fees will be regarded as “discretionary fees.”

- A fixed fee expressed to be “no less than” a certain amount or formulated as being within a percentage range is acceptable; however, in such cases the price floor would be regarded as the “fixed fee” amount. A fixed fee expressed as being “no more than” a certain amount does not meet the requirements.

- If any remaining portion of the fixed fees available originally budgeted for other CMIs is later reallocated at the issuer’s discretion to the original OCs, these fees will be regarded as “discretionary fees.”

- HKEx reiterated its expectation of a ratio of 75:25 between the fixed fee and the discretionary fee, and noted that regulators may make enquiries if a company significantly deviates from this ratio.

- When material changes are made to the original fee arrangements, regulators may treat such changes as a new engagement after assessing them on a case-by-case basis, considering the scale of and reasons for the changes. The two-month waiting period after appointment of an OC is deemed to commence on the day of such material changes.

HKEx Publishes Listing Decision on Unsuitable WVR Listing Applicant Suitability

HKEx recently issued a listing decision (LD138-2022) outlining HKEx’s observations about why certain applicants failed to demonstrate they were suitable to be listed using a weighted voting rights (WVR) structure. These applicants generally failed to differentiate themselves from existing market players, which is a key element of innovative companies. In particular, these applicants generally possess one or more of the following characteristics:

(i) an inability to demonstrate that their success is attributable to the application of new technologies, innovations, and/or a new business model to their core business;

(ii) research and development not being a significant contributor of their expected value or constituting a major activity and expense;

(iii) the absence of an outsized market capitalization relative to their tangible asset value; and

(iv) the absence of innovative technologies in their intellectual properties or a lack of relevance of such intellectual properties to the core business.

The listing decision includes discussion of a number of specific examples.

In making its assessment, HKEx takes into account all relevant facts and circumstances. HKEx urges applicants to include all relevant facts in pre-A1 submissions with a meaningful and balanced discussion of their core business, technologies and innovations (rather than making selective disclosures focusing only on favorable facts). Doing so will prevent the need for further information requests that will prolong the assessment.

HKEx Publishes Guidance on Good Record-Keeping

HKEx has issued its latest enforcement bulletin and emphasized the importance of adequate record-keeping in the context of audits and enforcement actions.

Record-keeping is an indispensable part of good corporate governance and is often legally required under statutory provisions. It allows directors to better monitor business and improve decision-making, and is especially important in the context of audits. HKEx notes that lack of proper record-keeping relating to valuation of assets, including lack of information on goodwill, plants and equipment, has led to modified opinions from auditors. Similarly, lack of record-keeping in relation to assumptions adopted in forecasts and historical financial information of newly acquired businesses and assets may also cause auditors to issue modified opinions. The guidance reminds directors of listed companies that they are responsible for maintaining proper internal controls and oversight over their businesses, including by extensively documenting key judgments.

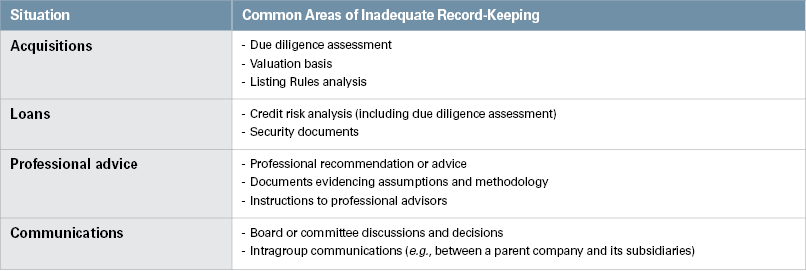

Poor record-keeping is a basis for HKEx to draw adverse inferences about a listed company and its directors and, consequently, may lead to the imposition of disciplinary sanctions against the listed company and the directors. Lack of proper records are an immediate signal that a listed company’s internal controls may be inadequate and that the listed company may not be compliant with the Listing Rules. Accordingly, HKEx is more likely to closely scrutinize the directors and their discharge of directors’ duties. Directors who rely solely on the company to keep all the records without making sure documentation was properly kept and who do not personally keep records may expose themselves to individual liability if they are not able to produce documentation in response to an HKEx enquiry. HKEx also highlights common situations where it has found poor record-keeping practices.

Takeovers Panel Rules a Special Waiver From the General Offer Obligation May Be Granted for an Involuntary Disposal That Leads to a Change in Concert Group Leader

The Takeovers and Mergers Panel was asked for a ruling on whether a mandatory general offer obligation would arise as a result of an involuntary disposal of an interest in Jinke Smart Services Group Company Limited (the Company), and, if so, whether a waiver may be granted. The panel would not normally consider hypothetical questions, but the matter was referred to the panel because particularly novel, important or difficult points were in dispute.

In December 2021, Broad Gongga Investment Pte. Ltd. (the purchaser) entered into a share purchase agreement with the Company’s controlling shareholder, Jinke Property Group Company Limited (the seller), to acquire 22% of the voting rights of the Company — out of the seller’s then existing 52.33% shareholding interest in the Company, following which the seller would hold 30.33% interest in the Company. On the same day, the purchaser as the lender entered into a loan facility agreement with a wholly owned subsidiary of the seller as the borrower. The seller also entered into three share pledge agreements with the purchaser whereby the seller pledged shares representing approximately 16.51% of the then total share capital of the Company in favor of the purchaser as security for the seller group’s obligations under the share purchase agreement, the facility agreement, the share pledge agreements and other agreements related to the acquisition (collectively, the 2021 Acquisition Agreements). The parties also entered into various arrangements regarding call options, consent rights, change-in-control call options and restrictions on transfers.

Parties sought confirmation from the panel as to whether a mandatory general offer obligation would be triggered if shares held by the seller were reduced to a level below the ownership percentage of the purchaser as a result of any foreclosure sale by the seller’s other third-party creditors to parties other than the purchaser (seller forced disposal), rather than a sale or acquisition by either the seller and the purchaser.

The purchaser and the seller are presumed to be acting in concert with each other by virtue of them controlling 20% or more of the voting rights of the Company. Under the seller forced disposal scenario, the purchaser would become the single largest shareholder and hence the leader of the concert group. The terms of the 2021 Acquisition Agreements would also provide the purchaser with various rights upon occurrence of the seller forced disposal and such rights would allow the purchaser to acquire control of the Company. Under the Code on Takeovers and Mergers, a mandatory general offer is required if control of a company changes or, under Note 1 to Rule 26.1, where there are changes in the makeup of a group acting in concert that effectively result in the forming of a new group or a significant change in the balance of the group.

The panel considered that the 2021 Acquisition Agreements, including the call option, consent rights, change-in-control call option and restriction-on-transfer arrangements, demonstrated an intention between the purchaser and the seller to cooperate with each other to consolidate control of the Company, and thus a concert party relationship was established.

The panel determined that Note 1 to Rule 26 should not be restrictively construed to refer only to a sale of voting rights. The enforcement of the security over the shares would be similar to a sale by the seller of the shares. However, the panel recognized that strict application of the rules may be unfair to the purchaser because the seller forced disposal would result from actions by third-party creditors of the seller and not as a result of any actions by the purchaser. Therefore, the panel proposed a special waiver under the circumstances of a seller forced disposal that would allow the purchaser’s obligation to make a mandatory general offer to be delayed until such time as the purchaser actually acquires any voting rights after the seller forced disposal.

Takeovers and Mergers Panel Rules on Appropriate Price for Mandatory General Offer

The Takeovers and Mergers Panel recently ruled on the appropriate price for a mandatory general offer. The panel considered that a shareholder of the target company obtained a favorable condition from the transaction triggering the mandatory offer and that such favorable condition should be extended to all other shareholders.

On 30 July 2021, Star Soul Investments Limited, a company wholly owned by Chau Cheok Wa, the then-chairman and executive director of Suncity Group Holdings Limited (Suncity), entered into a loan facility agreement with lenders to finance Star Soul’s general working capital. The repayment of the loan was secured by a charge over the various security assets (Suncity Securities), including a controlling stake in Suncity (Suncity Sale Shares).

In December 2021, Star Soul announced the arrest of Mr. Chau in Macau, after which he resigned as chairman and executive director of Suncity. The lenders announced an event of default based on the arrest, upon which the loan became immediately due and payable. As Star Soul failed to repay the loan, the lenders sought to enforce the securities by selling the loan along with the Suncity Securities through a professional intermediary, pursuant to which Lo Kai Bong made a successful bid to acquire the loan and the Suncity Securities in May 2022.

On 13 May 2022, the lenders assigned the loan together with the Suncity Securities to Champion Trade Group Limited, a company wholly owned by Mr. Lo, at a consideration of HK$344 million. On the same day, Major Success Group Limited, another company wholly owned by Mr. Lo, entered into two agreements with Champion Trade, including: (i) the assignment of the loan to and the acquisition of some of the Suncity Securities, including the Suncity Sale Shares, by Major Success at a consideration of HK$344 million; and (ii) the assignment and acquisition of the rest of the Suncity Securities at a nominal consideration of HK$5.

The acquisition resulted in Major Success and parties acting in concert with it (including Mr. Lo) acquiring a 74.98% interest in Suncity, which triggered a mandatory general offer to all other Suncity shareholders under the Takeovers Code. The appropriate price for the general offer was in dispute. The panel considered the appropriate price to be HK$0.069 per Suncity share, representing the total consideration paid by Major Success to Champion Trade for the acquisition of Suncity’s controlling stake divided by the total number of Suncity shares acquired by Major Success.

The panel reasoned that the transaction involved a discharge of Mr. Chau’s liability under the loan, which was a favorable condition to him as a shareholder, and that this constituted a special deal under the Takeovers Code. The existence of a favorable condition does not depend on whether the relevant shareholder makes an overall gain or a loss in the arrangement. Given that the benefit received by Mr. Chau is quantifiable (i.e., HK$344 million), it should be extended to all other Suncity shareholders.

Enforcement Matters

SFC Penalizes TC Capital and Responsible Officer for Sponsor Failures

The SFC publicly reprimanded and fined TC Capital International Limited (TC Capital) HK$3 million for its failure to conduct reasonable due diligence on third-party payments made on behalf of two top customers of China Candy Holdings Limited and to maintain proper records of the due diligence work allegedly done for the listing application of China Candy.

The third-party payments made on behalf of these two top customers accounted for around 45% of China Candy’s revenue during the track record period. The SFC noted that payments by top customers settled through third parties is an apparent red flag, as third-party payments might be used to disguise the original source of funds and/or facilitate a fraudulent scheme. Therefore it was imperative for TC Capital to conduct proper due diligence to understand the reasons behind the third-party payments as well as the background of the third parties and their relationship with China Candy, without which TC Capital could not properly assess whether the use of third-party payers by two top customers was material information that should be disclosed in the China Candy prospectus. Further, even if the matter did not warrant disclosure, TC Capital was expected to maintain documentation showing how such a conclusion had been reached.

In addition, the SFC considered that TC Capital’s failures were attributable to Mr. Edward Wu Wen Guang, the sponsor principal in charge of the listing application and the supervision of the transaction team at TC Capital. The SFC found that Mr. Wu failed to exercise due skill, care and diligence in handling the listing application, to diligently supervise the transaction team at TC Capital to carry out the sponsor work, and to ensure the maintenance of appropriate standards of conduct by TC Capital. The SFC suspended the license of Mr. Wu for seven months.

HKEx Takes Disciplinary Action Against Three Directors of Inno-Tech for Failure To Comply With Directions and Cooperate With Investigations

The recent resolution of HKEx’s Inno-Tech case highlights the obligations of directors, both individually and collectively, to ensure a listed company complies with the Listing Rules and cooperates with HKEx investigations.

In September 2018, following a previous disciplinary action by HKEx against Inno-Tech Holdings Limited and its directors, HKEx directed Inno-Tech to appoint an independent compliance adviser for two years. Inno-Tech subsequently changed its compliance adviser three times, as its executive director and chief executive officer at the time, Samuel Wong Kam Fai, persistently withheld payments from the compliance advisers (despite Mr. Wong’s confirmation to HKEx following its intervention that Inno-Tech was able to pay the second compliance adviser’s fees). Furthermore, Inno-Tech only engaged compliance advisers for a total period of one year and nine months, in breach of HKEx’s direction.

In January 2020, Inno-Tech announced the replacement of its auditor and stated in the announcement that it had confirmed that no matters or circumstances needed to be brought to the attention of the shareholders. However, Mr. Wong incorrectly represented to the board that the auditor had given such confirmation. Inno-Tech also failed to consult its compliance adviser in relation to the issue of this announcement.

Between May and November 2020, HKEx made numerous inquiries to Inno-Tech and its directors, including Mr. Wong, in relation to the above matters, but the directors failed to provide timely or adequate responses. As a result, HKEx found that the directors breached their undertakings to procure the company’s compliance with the Listing Rules and cooperation with HKEx inquiries. In particular, Mr. Wong also failed to apply reasonable skill, care and diligence in performing his duties as a director.

HKEx considered the breaches to be willful and persistent and issued a censure and a statement that the retention of these directors on the board of Inno-Tech would have been prejudicial to the interests of investors.

HKEx Takes Disciplinary Action Against Ping An Securities and Directors for Compliance Failure

The recent determination of HKEx in its Ping An case serves as a reminder that directors are expected to comply with a listed company’s internal rules and procedures and to procure the listed company’s compliance with the Listing Rules.

From July to September 2018, a subsidiary of Ping An Securities Group (Holdings) Limited granted loans to borrowers totaling approximately HK$273 million, which were approved by its then-executive directors, Gong Qing Li and Lin Hong Qiao, as members of the executive committee. However, Mr. Gong and Mr. Lin did not in fact have the power to approve the loans under the committee’s terms of reference, and they failed to report the loans to the other members of the executive committee or the board of directors as required.

Each of the loans constituted a disclosable transaction and was subject under the Listing Rules to requirements regarding announcement, circulation and shareholder approval. However, the relevant announcement was only made in October 2019, after a year’s delay, and Ping An Securities did not seek shareholders’ approval. The loans were not repaid and Ping An Securities suffered significant losses.

In July, September and November 2019, respectively, Mr. Gong and Mr. Lin led the disposal of Ping An Securities’ interest in (i) Lianrun Shanghai Information Technology by way of a trust arrangement, where the purchaser would hold Lianrun in trust for Ping An Securities without consideration, causing Ping An Securities to lose control of Lianrun; (ii) Super Harvest Asset Management at a nominal consideration of US$1, which disposal was canceled two days later; and (iii) Super Harvest Global Fund SPC, held by Ping An Securities through Super Harvest Asset Management, by way of a trust arrangement, causing Ping An Securities to lose control of Super Harvest Global Fund without receipt of any consideration. Each of the disposals was a disclosable transaction subject to the announcement requirement under the Listing Rules, but Ping An Securities did not make any announcements until March and June 2020. Furthermore, the Super Harvest disposals were not made known to the board.

Ping An Securities conducted internal investigations into the disposals. However, Mr. Gong and Mr. Lin did not provide justifications for the disposals in response to inquiries from Ping An Securities. In July 2020, Ping An Securities announced its findings and concluded that Mr. Gong executed the disposals with the assistance of Mr. Lin, among others. HKEx also investigated the disposals, but Mr. Gong and Mr. Lin did not cooperate with the investigation.

As a result, HKEx found that Ping An Securities breached the Listing Rules requirements applicable to the loans, which were disclosable transactions. Furthermore, it found that Mr. Gong and Mr. Lin breached their fiduciary duties, undertakings to HKEx and duties of skill, care and diligence by (i) failing to observe internal rules and procedures applicable to the loans, including the requirement to inform the board; (ii) conducting the unauthorized disposals by way of trust arrangements without any commercial justification; (iii) failing to cooperate with Ping An Securities’ internal investigations; and (iv) failing to cooperate with HKEx’s investigation.

Accordingly, HKEx censured Ping An Securities, Mr. Gong and Mr. Lin and issued a statement that retention of Mr. Gong and Mr. Lin on the board would have been prejudicial to the interests of investors.

HKEx Censures Enterprise Development and Former Director for Inaccurate Disclosure Relating to Director’s Appointment

The recent outcomes of HKEx’s Enterprise case emphasize that listed companies should ensure that the appointment of any individual to the board of directors is carefully considered and that announcements relating to the appointment are accurate and not misleading or deceptive. In particular, directors’ biographical information must be carefully and fully verified.

On 3 January 2021, Enterprise Development Holdings Limited announced the appointment of Mao Jun Jie to the position of executive director. The appointment announcement contained biographical details of Ms. Mao, citing her extensive financial experience, which Enterprise Development subsequently admitted in response to inquiries by HKEx were not verified. Enterprise Development also admitted that Ms. Mao’s appointment and remuneration had not been properly considered by the nomination and remuneration committee.

HKEx found Enterprise Development to be in breach of the Listing Rules for publishing inaccurate, incorrect and/or misleading information about Ms. Mao in the appointment announcement. HKEx also found Ms. Mao to be in breach of her duties under the Listing Rules for (i) providing inaccurate, incorrect and/or misleading information about her biographical details and (ii) failing to procure Enterprise Development’s compliance with the Listing Rules. Ms. Mao resigned as an executive director of Enterprise Development.

HKEx censured Enterprise Development and imposed a statement of prejudice to investors’ interests ruling that Ms. Mao’s retention on the board would have been prejudicial to the interests of investors.

HKEx Takes Disciplinary Action Against Former Directors for Failing To Cooperate With Investigations

Results of two recent HKEx cases underscore that directors of listed companies should pay close attention to their compliance undertakings under the Listing Rules to actively cooperate in investigations conducted by HKEx, or risk inviting sanctions for failure to respond promptly to HKEx’s enquiries or update HKEx with their latest contact details. A director’s belief that he/she has no relevant information for HKEx’s investigation is not an acceptable excuse for failing to respond. Such a failure will constitute noncooperation and will expose the director to imposition of severe sanctions.

HKEx reported the following two cases:

- In 2020, trading in the shares of China Creative Global Holdings Limited was suspended due to delay in publication of its financial statements. China Creative later announced that its major subsidiary, Allen International Holdings Limited, had been wound up by the judiciary of Hong Kong and that the shares of certain subsidiaries of Allen International in the People’s Republic of China had been disposed of. Some of China Creative’s directors at that time were suspended and later removed for their possible involvement in the unauthorized events concerning Allen International.

HKEx sent investigation letters and reminder letters in connection with the above matters to the directors’ correspondence and/or email addresses but did not receive any response. None of the directors had notified HKEx of changes to their contact details.

- HKEx conducted an investigation of events that took place in 2019 and 2020 at National Investments Fund Limited. HKEx sent investigation letters and reminder letters to each of the four relevant directors and spoke to each of them via telephone to inform them about the investigation. However, the directors did not respond. Two directors contacted HKEx after disciplinary proceedings had commenced with explanations for their failure to cooperate, but none of the explanations were deemed justified.

HKEx ruled that all relevant directors had committed a serious breach of their undertakings to HKEx, which provide that directors shall: (i) cooperate in any HKEx investigation; (ii) promptly and openly answer any questions addressed to them; and (iii) provide their current and active contact details to HKEx for a period of three years from the date on which they cease to be directors of those companies.

HKEx imposed opinion statements against the former directors of China Creative and National Investments stating that each of the directors is unsuitable to occupy a position as a director or senior management of the relevant companies.

SFC and Police Investigate Suspected Corporate Fraud

Suspected fraudulent transactions involving a company previously listed on the HKEx is currently under investigation.

In a joint investigation conducted by the SFC and the police in early July 2022, eight current and former executive directors and senior executives of a company were arrested. They are suspected to have caused the company to enter into fraudulent transactions totaling over HK$130 million and published false or misleading announcements and financial statements to hide the fraud while the company was listed on the HKEx. The transactions involved a loan granted to a related party and payments and prepayments made to suppliers for goods or services. However, the company did not seem to have received the goods or services it had paid for, and a significant amount of the money it had supposedly paid to its supplier went instead to its related parties.

The investigation emphasized the SFC’s commitment to combating corporate fraud and misconduct and highlighted the need for listed companies to regularly review procedures for approving transactions. If companies come across any potential red flags, they should take steps to ensure these are addressed promptly. Most importantly, companies should maintain an audit trail and retain copies of related documents in case directors and senior executives are later asked to justify their decisions.

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.