Part III: Energy, Water and Broadband Infrastructure

Editor’s note: This client alert has been updated with details on the September 22, 2022, funding opportunity announcement for regional clean hydrogen hubs.

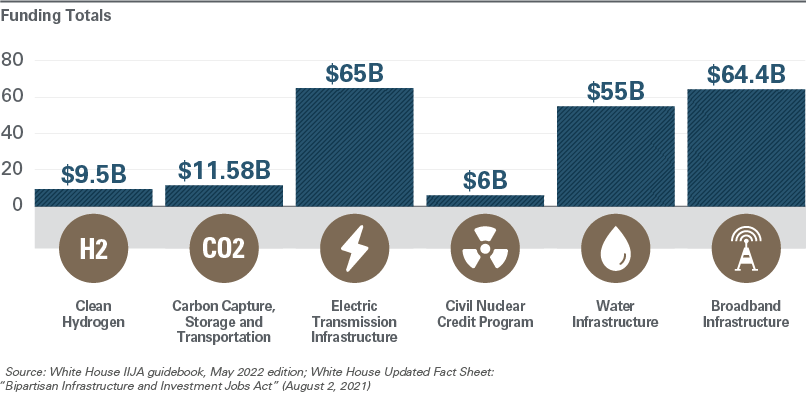

The energy-related provisions of the Infrastructure Investment and Jobs Act (IIJA) provide substantial support for clean hydrogen, carbon capture and sequestration, storage and transportation, electric transmission, and at-risk nuclear reactors. The law contains the largest investment in clean energy transmission in U.S. history,1 in preparation for integrating ever-increasing amounts of renewable energy.

According to the latest edition of the White House IIJA guidebook, the IIJA contains a total of $74.95 billion for new and existing clean energy and power programs. This amount includes not only funding for delivering clean energy but also for clean energy demonstrations; energy efficiency and weatherization retrofits for homes, buildings and communities; clean energy manufacturing; and workforce development. Significant complementary tax credits and/or other funding in support of clean hydrogen, carbon capture and storage, transmission, nuclear power, advanced manufacturing, clean fuels and clean vehicles are being provided in the recently enacted Inflation Reduction Act (IRA).2

The IIJA also provides substantial funding for water infrastructure, again the largest investment in clean drinking water and wastewater infrastructure in U.S. history,3 and for broadband infrastructure to increase access to affordable, reliable, high-speed internet.4

In Part III of our four-part series, we focus on these energy, water and broadband-related funding programs.

Clean Hydrogen

The IIJA provides a total of $9.5 billion to fund clean hydrogen development, including through Department of Energy (DOE) solicitations to establish regional clean hydrogen hubs and through the establishment of a new program designed to reduce the cost of hydrogen produced using electrolyzers.

Regional Clean Hydrogen Hubs ($8 Billion for FY 2022-26, To Remain Available Until Expended)

The secretary of energy is directed to establish a new program to support the development, through grants and other measures, of at least four regional clean hydrogen hubs, defined as a network of clean hydrogen producers, potential consumers and connective infrastructure located near each other. The hubs are designed to accelerate commercialization of, and demonstrate the production, processing, delivery, storage, and end use of, clean hydrogen in order to develop a national network to facilitate a clean hydrogen economy.

Implementation Efforts: On February 15, 2022, the DOE published the Hydrogen Hubs Implementation Strategy request for information (RFI), which sought public input on the solicitation process and structure of a DOE funding opportunity announcement (FOA) for regional clean hydrogen hubs. The DOE received over 300 responses to the RFI. On June 2, 2022, the DOE’s Office of Clean Energy Demonstrations (OCED)5 issued a notice of intent (NOI) for an FOA covering all phases of regional clean hydrogen hubs development, including planning, project development, permitting, financing, installation, integration, construction, ramp-up and operation.

Under the initial FOA, which was issued on September 22, 2022, the DOE seeks to select between six and 10 regional clean hydrogen hubs and utilize $6-7 billion to support those hubs, with the remaining $1-2 billion reserved for future regional clean hydrogen hub launches or other supporting activities. The DOE anticipates that it will award funding for each hub in a minimum range of $400-500 million and in a maximum range of $1-1.25 billion, representing up to a 50% federal cost share to be executed over approximately eight to 12 years. The 50% nonfederal cost share may come from project participants, state or local governments, or through other third-party financing. Federal financing, such as the DOE loan guarantees, cannot be leveraged by applicants to provide the required cost share or otherwise cover the same scope that is proposed for a related regional clean hydrogen hub. Concept papers from potential applicants are due by November 7, 2022, and full applications are due by April 7, 2023. The DOE will issue awards to selected regional clean hydrogen hubs sometime during the winter of 2023-24.6 (Editor’s note: This paragraph has been updated to reflect new developments.)

Clean Hydrogen Electrolysis Program ($1 Billion for FY 2022-26, To Remain Available Until Expended)

The secretary of energy is directed to establish a research, development, demonstration, commercialization, and deployment program. The key goal of this program is to reduce the cost of hydrogen produced using electrolyzers to less than $2 per kilogram of hydrogen by 2026.

Implementation Efforts: On February 15, 2022, the DOE’s Hydrogen and Fuel Cell Technologies Office published the Clean Hydrogen Manufacturing, Recycling and Electrolysis RFI. The window to submit responses closed on March 29, 2022.

Carbon Capture, Storage and Transportation

The IIJA includes several measures that will help the development of carbon capture, utilization and sequestration (CCUS) projects and technologies, as summarized below.

Private Activity Bonds To Finance Carbon Capture

The IIJA expands the scope of projects that may use private activity bonds (PABs) to encompass qualified carbon dioxide capture facilities. PABs have been instrumental to providing low-cost, long-term financing to infrastructure projects, primarily in the transportation sector. PABs will be an important financing tool for private sector developers of carbon capture projects.

Carbon Dioxide Transportation Infrastructure Finance and Innovation (CIFIA) Program ($2.1 Billion for FY 2022-26, To Remain Available Until Expended)

As we will discuss in greater detail in Part IV of this series, the IIJA establishes a $2.1 billion federal credit program within the DOE to provide loans and loan guarantees for common carrier carbon dioxide transportation infrastructure or associated equipment (including pipelines, shipping, rail or other transportation infrastructure and associated equipment) that will transport or handle carbon dioxide captured from anthropogenic sources or ambient air. The IIJA authorizes $600 million for the CIFIA program for each of federal fiscal years (FY) 2022 and 2023 and $300 million for each of federal FY 2024 through 2026. Like other federal credit programs, the authorized funding amount corresponds to the amount available to pay credit subsidy costs, which are similar in purpose to loan loss reserves. Actual lending capacity will be closer to $20 billion.

Carbon Storage Validation and Testing ($2.5 Billion for FY 2022-26, To Remain Available Until Expended)

The secretary of energy is directed to establish the Large-Scale Carbon Storage Commercialization Program, under which funding will be provided to both private and public sector entities for the development of new or expanded large-scale carbon sequestration projects and associated carbon dioxide transport infrastructure. Funds will also be set aside for feasibility studies, site characterization, permitting, and construction for carbon capture and storage projects.

Implementation Efforts: An NOI to issue an FOA was issued in April 2022. The window to submit responses closed on June 27, 2022. The DOE is expected to issue an FOA by the end of September 2022.

Regional Direct Air Capture Hubs ($3.5 Billion for FY 2022-26, To Remain Available Until Expended)

The secretary of energy is directed to establish a program to provide funding to public and private sector entities for the development of four regional direct air capture hubs. The statutory requirements for each regional direct air capture hub are that it: (i) facilitates the deployment of direct air capture projects; (ii) has the capacity to capture and sequester, utilize or sequester and utilize at least 1 million metric tons of carbon dioxide from the atmosphere annually from a single unit or multiple interconnected units; (iii) demonstrates the capture, processing, delivery and sequestration or end use of captured carbon; and (iv) has the potential to be developed into a regional or interregional carbon network to facilitate sequestration or carbon utilization.

Implementation Efforts: An NOI to issue an FOA was issued in May 2022. The DOE is expected to issue an FOA in the fourth quarter of 2022.

Carbon Capture Large-Scale Pilot Program ($937 Million for FY 2022-25, To Remain Available Until Expended)

The IIJA provides funding, available to both public and private sector entities, for a Carbon Capture Large-Scale Pilot Program. This program will focus on developing transformational technologies that significantly improve the efficiency, effectiveness, cost limitation, emissions reductions and environmental performance of facilities — including in manufacturing and industrial facilities — that use coal and natural gas. Eligible pilot projects include, among others, projects that utilize a scale of technology development that is beyond laboratory development and bench-scale testing but is not yet advanced to the point of being tested under real operational conditions at commercial scale.

Implementation Efforts: An amended RFI was issued in January 2022. The window to submit responses closed on February 1, 2022. The DOE is expected to issue an FOA in the first quarter of 2023.

Carbon Capture Demonstration Projects Program ($2.54 Billion for FY 2022-25, To Remain Available Until Expended)

The IIJA provides funding to public and private sector entities for the Carbon Capture Demonstration Projects Program. This program will focus on integrated carbon capture, transport, and storage technologies and infrastructure that can be readily replicated and deployed at fossil fuel plants and major industrial sources of carbon dioxide (such as cement, pulp and paper, iron and steel, and certain types of chemical production facilities). Selected projects will address technical, environmental, permitting and financing challenges for commercial deployment.

There will be multiple phases in this program:

- Phase 1 will address completion of front-end engineering and design (FEED) studies and permitting. Approximately $160 million will be available for Phase 1 awards.

- Phases 2-4 will address detailed design, construction and operation of six demonstration projects. Of these six projects, two shall capture carbon dioxide from coal-fired facilities, two from natural gas-fired facilities and two from industrial facilities not purposed for electric generation. Approximately $2.1 billion will be available for Phases 2-4 awards.

Program recipients for each phase will be responsible for funding at least 50% of the costs of the work being supported by the program.

Implementation Efforts: An NOI to issue an FOA was issued in July 2022. The OCED, in collaboration with the Office of Fossil Energy and Carbon Management (FECM) and National Energy Technology Laboratory (NETL), expects to issue the FOA by the end of September 2022.

Electric Transmission Infrastructure

The IIJA provides expanded transmission line siting authority to the Federal Energy Regulatory Commission (FERC) and authorizes approximately $65 billion in new spending7 to build out and modernize the U.S. electric transmission system.

Siting of Interstate Electric Transmission Facilities

The IIJA provides, among other things, the FERC with “backstop” siting authority to issue construction permits for construction or modification of certain interstate transmission facilities (within designated National Interest Electric Transmission Corridors). This provision applies in circumstances where a state commission or other entity that has authority to approve the siting of such facilities has (i) not made a determination on an application by the date that is one year after the later of either the date on which the application was filed or the date on which the relevant National Interest Electric Transmission Corridor was designated by the secretary of energy, (ii) “conditioned its approval in such a manner that the proposed construction or modification will not significantly reduce transmission capacity constraints or congestion in interstate commerce or is not economically feasible,” or (iii) denied an application.

Transmission Facilitation Program ($10 Million for Each of FY 2022-26, To Remain Available Until Expended)

The IIJA establishes the Transmission Facilitation Program (TFP) under which the secretary of energy shall facilitate the construction of new electric transmission lines and related facilities through a $2.5 billion Transmission Facilitation Fund, a revolving loan fund to be established in the Department of the Treasury. The secretary of the treasury may loan to the secretary of energy such sums as are required to carry out the TFP, not to exceed $2.5 billion. Amounts borrowed by the secretary of energy, together with all amounts received as receipts, collections and recoveries relating to the eligible projects supported under the TFP (such as capacity contract marketing receipts, loan repayments and eligible entity contributions under a public-private partnership, or P3) and any amounts appropriated for the program, will be placed in the Transmission Facilitation Fund.

Under the TFP, the secretary of energy has three tools available to use:

Anchor Customer. The secretary of energy is authorized to enter into capacity contracts whereby the DOE can serve as an “anchor tenant” for new or replacement electric transmission lines, capacity expansions of existing electric transmission lines or for projects that connect isolated microgrids in Alaska, Hawaii or the U.S. territories, so as to encourage other entities to enter into contracts for the remaining transmission capacity. To be eligible, electric transmission lines should be capable of transmitting either not less than 1 GW or, in the case of an upgrade or a new transmission line in an existing transmission, transportation or telecommunications infrastructure corridor, not less than 500 MW.

The secretary of energy would acquire up to 50% of the proposed transmission capacity of the eligible project for a term of not more than 40 years, which may then be sold to third parties via a competitive solicitation once a project’s financial viability has been demonstrated.

Loans. The secretary of energy can make loans to carry out eligible projects. The TFP loan process is expected to be similar to the existing process used by the DOE Loan Programs Office and Federal Power Marketing Administrations for evaluating DOE loans and loan guarantees.

P3s. The secretary of energy can enter into a P3 with eligible entities in designing, developing, constructing, operating, maintaining or owning an eligible project, if the secretary of energy determines the eligible project, among other things, is (i) located in a National Interest Electric Transmission Corridor or is necessary to accommodate an increase in demand for interstate transmission, and (ii) consistent with the efficient and reliable operation of the transmission grid. In addition, the secretary of energy, acting through the administrators of the DOE’s Southwestern Power Administration (SWPA) and Western Area Power Administration (WAPA), has the authority to design, develop, construct, operate, maintain or own, alone or in partnership with third parties, transmission system upgrades or new transmission lines and related facilities in the SWPA or WAPA states.

There are a number of certifications that need to be made prior to the secretary of energy facilitating an eligible project, including, among other things, that (i) the project is in the public interest; (ii) the project is unlikely to be constructed in the absence of facilitation under this section, including with respect to an eligible project for which a federal investment tax credit (ITC) may be allowed; and (iii) there is a reasonable prospect of either cost recovery under a capacity contract, or loan repayment in the case of a loan to an eligible project, or repayment of amounts borrowed from the secretary of the treasury.

Implementation Efforts: As part of the DOE’s Building a Better Grid Initiative, launched on January 12, 2022, the department issued an NOI which, among other things, described the TFP and the DOE’s plans to establish procedures for administration of the program and for solicitation and selection of project applications.

On May 10, 2022, the DOE issued an NOI/RFI seeking public input on the structure of the TFP. The comment period closed on June 13, 2022. The DOE expects to issue an initial solicitation in 2022, which will be limited to applicants seeking capacity contracts for eligible projects that are scheduled to achieve commercial operation by no later than December 31, 2027. The DOE is expected to issue another NOI/RFI in the first quarter of 2023 that will incorporate the loan and P3 financing tools.

Civil Nuclear Credit (CNC) Program ($1.2 Billion for Each of FY 2022-26, To Remain Available Until Expended)

The secretary of energy is directed to establish a $6 billion credit allocation program for FY 2022-26 to evaluate nuclear reactors that are projected to retire due to economic factors (“at-risk nuclear reactors”) and to allocate credits to certified nuclear reactors that operate in competitive electricity markets. The program’s intent is to allocate credits to as many certified at-risk nuclear reactors as possible. The secretary of energy may allocate program credits up until September 30, 2031. The credits are subject to recapture as provided for by the secretary of energy if a certified at-risk nuclear reactor terminates operations or does not need the credits to operate profitably.

Implementation Efforts: Following an NOI and an RFI for implementation of the CNC Program issued on February 11, 2022, the DOE on April 19, 2022, requested applications for certification and sealed bid submissions under the CNC Program to support continued operation of U.S. nuclear reactors. The first CNC award cycle prioritizes at-risk nuclear reactors that have already announced their intention to cease operations. Subsequent award cycles, including a second award cycle to be launched in the first quarter of 2023, will not be limited to such nuclear reactors with intentions to retire. The DOE also issued CNC guidance on how to apply for funding to avoid premature closure. Applications closed on September 6, 2022. The DOE expects to execute a credit redemption agreement, make a final award selection and issue credits for the first CNC award cycle to the selected nuclear reactors as soon as reasonably practical after the announcement of the conditional award decisions.8

Water Infrastructure

The IIJA authorizes approximately $55 billion of new spending9 for water infrastructure and technologies, mostly through block funding and grants to state and local entities and appropriations to federal agencies. The IIJA also renews appropriations for the WIFIA (Water Infrastructure Finance and Innovation Act) federal credit program, a recent but fast-growing program that makes long-term, low interest loans to public sector entities and P3 developers and makes a technical amendment to the WIFIA statute. Lastly, the IIJA appropriates funding to the U.S. Army Corps of Engineers (USACE)’s WIFIA program account, as USACE has its own separate lending authority under the WIFIA statute. These appropriations and amendments are summarized below.

WIFIA Program Appropriations for the Environmental Protection Agency (EPA)

The IIJA authorizes for appropriation to the EPA $50 million for each of FY 2022-26 for WIFIA loans. Each dollar authorized translates into more than $100 of credit assistance, implying annual lending authority in excess of $5 billion. An amount of $5 million is appropriated to pay for administrative costs of the WIFIA program, including the provision of technical assistance to aid project sponsors in obtaining necessary project approvals.

Implementation Efforts: In June 2022, the EPA announced the 2022 notice of funding availability for applications for credit assistance under the WIFIA program. Letters of interest submissions opened on September 6, 2022, and may be submitted on an ongoing basis. This year’s funding will provide up to $5.5 billion in total WIFIA financing.

WIFIA Program Appropriations for the USACE

The IIJA appropriates $75 million to the USACE’s WIFIA-related program. Of these amounts, $64 million is dedicated to making direct loans and for the cost of guaranteed loans, for safety projects, and to maintain, upgrade and repair dams identified in the National Inventory of Dams that are primarily owned by nonfederal entities. The other $11 million is allocated for administrative expenses to carry out the direct and guaranteed loan programs.

Technical Amendments to the WIFIA Statute

WIFIA borrowers are required to obtain investment-grade credit ratings on senior project debt. Since its inception, WIFIA has required two such credit ratings. The IIJA changes the obligation to one such credit rating, which helps reduce transaction costs to WIFIA borrowers. The IIJA also directs the EPA to develop and begin implementation of an outreach plan to promote financial assistance under the WIFIA program to small communities and rural communities. A rural community is a city, town or unincorporated area that has a population of no more than 10,000 inhabitants.

Broadband Infrastructure

The IIJA authorizes approximately $64.4 billion of new and existing spending for broadband infrastructure and access through the following programs.

Broadband Equity, Access and Deployment (BEAD) Program ($42.45 Billion, To Remain Available Until Expended)

The assistant secretary of commerce for communications and information (assistant secretary) is directed to establish the BEAD Program to be administered by the Department of Commerce’s National Telecommunications and Information Administration (NTIA). The BEAD Program will provide grants to fund construction and deployment of broadband infrastructure of at least 100 Mbps downstream and 20 Mbps upstream. Grant recipients may use funds to award subgrants to “non-traditional broadband providers” (which may be private sector, public sector or nonprofit entities) for the deployment of a broadband network. The IIJA prioritizes projects for unserved and underserved communities, connecting eligible community anchor institutions, data collection, broadband mapping and planning, among other uses. Grantees and subgrantees must provide a matching contribution from nonfederal funds of not less than 25% of project costs, except in high-cost areas or as otherwise provided in the IIJA.

Implementation Efforts: On May 13, 2022, the NTIA issued a notice of funding opportunity (NOFO) for the BEAD Program. Letters of interest were due on July 18, 2022, and requests for initial planning funds were due on August 15, 2022. On August 17, 2022, the NTIA announced that all states and territories had submitted applications for initial planning funds. The NTIA will evaluate the applications and make awards as expeditiously as possible. Within 270 days of receipt of initial planning funds, states and territories are required to submit a five-year action plan. The NTIA is expected to issue program fund allocations and a notice of available amounts for funding on or after the date on which the Federal Communications Commission (FCC) makes public its updated Broadband Deployment Accuracy and Technology Availability (DATA) maps. The FCC is targeting November 2022 for release of the first draft of the maps. After this milestone is achieved, eligible entities will be permitted to submit initial proposals for funding. Deadlines for final proposals and other action items will be identified after release of the updated Broadband DATA maps.

Enabling Middle Mile Broadband Infrastructure Program ($1 Billion for FY 2022-26, To Remain Available Until September 30, 2026)

The assistant secretary is directed to establish a program for middle mile grants, to be administered by the NTIA, under which the assistant secretary will make grants on a technology-neutral, competitive basis to eligible entities (including states, technology companies, electric utilities and telecommunications companies, among others) for the construction, improvement or acquisition of “middle mile” infrastructure (defined as any broadband infrastructure that does not connect directly to an end-user location, including an anchor institution). Middle mile grants cannot exceed 70% of the total costs of a project supported by such grants.

Implementation Efforts: On May 13, 2022, the NTIA issued an NOFO for this program. Applications may be submitted through September 30, 2022. Notices of awards are expected to be issued on or after March 1, 2023.

Private Activity Bonds To Finance Broadband

The IIJA expands the scope of projects that may use PABs to encompass qualified broadband projects.

Takeaways

Congress has authorized significant federal spending and new funding programs to support infrastructure development in the electric generation and transmission, carbon capture, water and broadband sectors. Implementing departments and agencies have issued a range of NOFOs, RFIs and NOIs to implement these programs. Some initial funding should be available in late 2022, but the majority of programs will begin funding in 2023.

In certain areas, such as clean hydrogen and carbon capture, the IIJA establishes ambitious goals and funding limits. But these programs also require the most institutional development by the implementing departments and agencies to actualize the projects that the IIJA seeks to promote. The DOE has taken important steps to provide additional tools to advance these technologies, such as (i) the new H2 Matchmaker tool designed to help clean hydrogen producers, end users and/or other stakeholders find opportunities in proximity to one another and form the regional clean hydrogen hubs that will receive IIJA funding and (ii) the Carbon Capture Matchmaker tool, which performs a similar function as the H2 Matchmaker.

Coming Up Next

Part IV of this four-part series will focus on the DOE Loan Programs Office’s Title XVII Innovative Energy Loan Guarantee Program and the Advanced Technology Vehicles Manufacturing (ATVM) Loan Program. The IIJA and the recently enacted IRA seek to reinvigorate those programs in support of innovative energy technologies and domestic advanced technology vehicle manufacturing.

_______________

1 White House Updated Fact Sheet: “Bipartisan Infrastructure and Investment Jobs Act” (August 2, 2021); White House Fact Sheet: “The Bipartisan Infrastructure Investment and Jobs Act Advances President Biden’s Climate Agenda” (August 5, 2021).

2 For more information, see our August 7, 2022, client alert “Senate Passes Landmark Bill With Climate, Tax, Energy and Health Care Implications.”

3 White House Updated Fact Sheet: “Bipartisan Infrastructure and Investment Jobs Act” (August 2, 2021).

4 Except as otherwise specified in Part III, the numbers for the principal IIJA programs referenced herein are as per the May 2022 version of the White House’s “Guidebook to the Bipartisan Infrastructure Law for State, Local, Tribal, and Territorial Governments, and Other Partners.” For the latest version of the guidebook, together with an IIJA program search feature, refer to the “Building a Better America” page.

5 In collaboration with the DOE’s Hydrogen and Fuel Cell Technologies Office and the DOE Hydrogen Program.

6 Also on September 22, 2022, the DOE’s Hydrogen and Fuel Cell Technologies Office issued draft guidance for a Clean Hydrogen Production Standard (CHPS). This draft guidance establishes an initial target for hydrogen production that results in life cycle greenhouse gas emissions of not greater than 4 kilograms of carbon dioxide equivalent per kilogram of hydrogen produced. Comments are due by October 20, 2022. Regional clean hydrogen hubs will be required to “demonstrably aid achievement” of the CHPS.

7 White House Updated Fact Sheet: “Bipartisan Infrastructure and Investment Jobs Act” (August 2, 2021).

8 “DOE Seeks Applications, Bids for $6 Billion Civil Nuclear Credit Program” (April 19, 2022); see also June 2022 Amended Civil Nuclear Credit Program Guidance.

9 White House Updated Fact Sheet: “Bipartisan Infrastructure and Investment Jobs Act” (August 2, 2021).

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.