Part I: Transportation Infrastructure and Provisions Related to Public-Private Partnerships

Overview

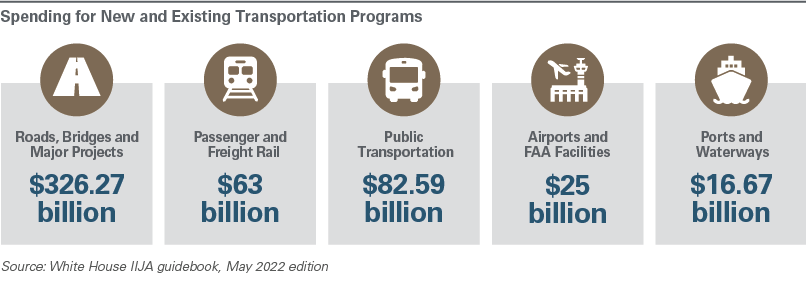

The Infrastructure Investment and Jobs Act (IIJA), signed into law on November 15, 2021, authorizes historic investments in U.S. infrastructure, including approximately $550 billion of new federal investments (out of about $1.2 trillion in total spending) across a comprehensive range of infrastructure asset classes.1 The IIJA is the first major infrastructure law enacted since the Fixing America’s Surface Transportation (FAST) Act of 2015 and has since been followed by the Inflation Reduction Act, which President Joe Biden signed into law on August 16, 2022, and which authorizes a further $369 billion of infrastructure-related funding. Together, these new laws will act as the catalyst for significantly increased investments in U.S. infrastructure over the next decade.

In this four-part series, we outline the programs and funding under the IIJA that we believe will catalyze private sector investment in the transportation, energy, carbon capture, water and broadband sectors.2 We begin by examining IIJA provisions related to transportation infrastructure (other than electric vehicles (EVs) and related components, which are addressed in Part II) and those directly related to public-private partnerships (P3s).

In the rest of the series, we analyze the following measures:

- Part II: EVs and EV-related manufacturing;

- Part III: Energy, carbon capture, water and broadband infrastructure; and

- Part IV: Department of Energy (DOE) loan programs.

Implementation Priorities

In January 2022, the White House released the first edition of its IIJA guidebook,3 which offers more details on funding that will be available for state, local, tribal and territorial governments, and other Skadden Partnersinterested in pursuing projects under the IIJA.

Following its passage, the primary federal initiatives undertaken pursuant to the IIJA have included:

- issuance of a White House executive order that outlines the administration’s implementation priorities and establishes an Infrastructure Implementation Task Force that will coordinate implementation of the IIJA through various federal agencies;4

- the launching of the Building a Better Grid Initiative by the DOE to catalyze the buildout of long-distance transmission lines;

- the DOE’s release of “America’s Strategy To Secure the Supply Chain for a Robust Clean Energy Transition;”

- the issuance of state allocations and guidance under the IIJA’s new $5 billion National Electric Vehicle Infrastructure (NEVI) Formula Program by the new Joint Office of Energy and Transportation;

- the announcement of a Presidential Determination on invoking the Defense Production Act of 1950 (DPA) to support domestic mining and processing of critical minerals and materials (such as lithium, nickel, cobalt, graphite and manganese used in lithium-ion batteries for EVs and energy storage), which authorizes the Department of Defense (DOD) to make purchases and purchase commitments and/or take other actions to support and promote the domestic production of critical minerals and materials;

- the announcement of IIJA funding available for fiscal year (FY) 2022 for roads, bridges, airports, transit, rail, ports, waterways, flood mitigation, broadband, clean water, critical mineral refining, and battery manufacturing for EVs and energy storage;

- the announcement of guidance for complying with the IIJA’s “Build America, Buy America” provisions by May 14, 2022.5 The U.S. Department of Transportation (U.S. DOT) subsequently issued a temporary waiver of “Buy America” requirements for construction materials for a period of 180 days beginning on May 14, 2022, and expiring on November 10, 2022; and

- the announcement of the Climate Smart Buildings Initiative, which intends to leverage P3s to modernize federal buildings in order to reduce greenhouse gas emissions. The initiative will establish federal agency emissions reductions targets and is expected to catalyze over $8 billion of private sector investment by 2030 through energy savings performance contracts. The initiative will also leverage $250 million in funding from the IIJA. The DOE’s Assisting Federal Facilities With Energy Conservation Technologies (AFFECT) program will provide additional funding to promote innovative decarbonization strategies through performance contracting.

Transportation Infrastructure

The IIJA establishes new programs to fund improvements to roads and bridges, expand and modernize rail and transit networks, deploy zero-emission transit fleets, build-out EV charging station networks, and upgrade ports, waterways, and airports. Most of the funding will be provided through grants and expanded capacity for key federal credit programs, such as TIFIA (Transportation Infrastructure Finance and Innovation Act), RRIF (Railroad Rehabilitation and Improvement Financing) and PABs (private activity bonds).

Roads, Bridges and Major Projects

The IIJA authorizes $326.27 billion for new and existing programs, including the following five-year competitive grant programs:

- Bridge Investment Program ($12.2 billion): for projects to replace, rehabilitate, preserve or protect some of the nation’s most important and economically significant bridges;

- Rebuilding American Infrastructure With Sustainability and Equity (RAISE) Program (formerly BUILD and TIGER grants) ($7.5 billion): for road, rail, transit and other surface transportation of local and/or regional significance;

- Infrastructure for Rebuilding America (INFRA) Program (including the State Incentives Pilot Program) ($8 billion): to support freight and highway projects of regional and national significance; and

- National Infrastructure Project Assistance (Megaprojects) ($5 billion): to support multijurisdictional or regional projects of significance, including multimodal projects. Of the authorized funding available for this program, 50% is to be set aside for projects that have a total cost of more than $100 million but less than $500 million.

Implementation Efforts: On June 10, 2022, the U.S. DOT via the Federal Highway Administration (FHWA) issued a NOFO for three categories of Bridge Investment Program funding opportunities: (i) Planning – applications were due by July 25, 2022; (ii) Large Bridge Projects (projects with eligible costs greater than $100 million) – applications were due by August 9, 2022; and (iii) Bridge Projects (projects with eligible costs less than $100 million) – applications are due by September 8, 2022. A total of nearly $2.4 billion in 2022 IIJA funding is available for Bridge Projects and Large Bridge Projects. Making funding available not only for construction but also for the planning process may enable state and local governments to bear the cost of evaluating and implementing a P3 to deliver large bridge projects.

On March 23, 2022, the U.S. DOT issued a combined NOFO (later amended on May 18, 2022) for $2.9 billion for the INFRA, Megaprojects and Rural Surface Transportation Grant programs. Applications were due by May 23, 2022. Awards are expected to be made in late 2022. On March 22, 2022, the U.S. DOT issued an amended NOFO for $1.5 billion of funding under the RAISE Program. Applications were due by April 14, 2022. Awards will be announced by no later than August 12, 2022.

Passenger and Freight Rail

The IIJA authorizes $63 billion for new and existing programs, including the Federal-State Partnership for Intercity Passenger Rail Grants ($36 billion), a competitive grant program for capital projects that reduce the backlog for repairs, improve performance, or expand or establish new intercity passenger rail service, including privately operated intercity passenger rail service.

Implementation Efforts: The Federal Railroad Administration is expected to issue a NOFO in the fall of 2022.

Public Transportation

The IIJA authorizes $82.59 billion for new and existing programs, including the Capital Investment Grants (CIG) Program ($8 billion), a competitive grant program that supports new and expanded high-capacity rail (heavy, commuter and light), street cars and bus rapid transit.

Implementation Efforts: On March 15, 2022, the Federal Transit Administration (FTA), issued a notice of availability of initial guidance proposals to implement changes the IIJA has made to the CIG Program. Public comments were due by April 14, 2022. Following review and consideration of comments, the FTA will issue a final notice and incorporate any changes into the existing CIG Final Interim Policy Guidance, which was last issued in June 2016.

Airports and Federal Aviation Administration (FAA) Facilities

The IIJA authorizes $25 billion for new and existing programs, including:

- Airport Infrastructure Grant Program ($15 billion): a five-year grant formula program that supports maintenance and improvement projects at airports, including terminal buildings. The program also includes $100 million ($20 million annually) specifically for airport-owned airport traffic control towers. Both public and private entities are able to receive funding under this program.

Implementation Efforts: On December 16, 2021, the FAA announced that it will award $2.89 billion of FY 2022 IIJA funds under the program to 3,075 airports. The FAA is expected to issue guidance and begin awarding grants to specific airports based on the FY 2022 airport allocations announced in December 2021. According to the FAA’s website, $2.89 billion (FY 2022 funds) has been made available. On April 20, 2022, the FAA issued a NOFO for the FAA Contract Tower (FCT) Competitive Grant Program. Applications for the FCT Competitive Grant Program closed on May 16, 2022. According to the FAA’s website, the first $20 million (FY 2022 funds) has been awarded to fund 20 projects.

- Airport Terminal Grant Program ($5 billion): a new five-year competitive grant program that supports airport terminal development (passenger terminal buildings, including terminal gates), multimodal projects and airport-owned traffic control towers. Both public and private entities are eligible to receive grants under this program.

Implementation Efforts: On July 7, 2022, the FAA announced that it would award nearly $1 billion of FY 2022 funds under the program to 85 airports. The FAA’s website currently reports that the first $1 billion (FY 2022 funds) has been awarded in full to more than 90 airports.

Ports and Waterways

The IIJA authorizes $16.67 billion for new and existing programs, including the Port Infrastructure Development Program (PIDP) ($2.25 billion), a 10-year competitive grant program that provides support for the modernization and expansion of U.S. ports for both public and private ports, as well as for the port authorities.

Implementation Efforts: On February 23, 2022, the U.S. DOT’s Maritime Administration (MARAD) issued a FY 2022 PIDP NOFO, which was amended on May 6, 2022. According to the amended NOFO, there is a total of $684.3 million in funding for FY 2022 PIDP grants, including $450 million for the PIDP under the IIJA and an additional $234.3 million in appropriated funds already available for the PIDP under the Consolidated Appropriations Act, 2022 (the FY 2022 Appropriations Act). The deadline for applications was May 16, 2022. Selections are expected to be announced in the fall of 2022.

TIFIA and RRIF Program Funding and Amendments

The TIFIA and RRIF federal credit programs are key sources of low-cost, long-term financing for surface transportation and rail infrastructure projects. TIFIA loans support a substantial portion of U.S. surface transportation P3s that have reached financial close. The IIJA renews funding for these programs and makes technical amendments to their authorizing statutes.

TIFIA ($1.25 Billion)

Section 11101 of the IIJA authorizes $250 million per year for FY 2022 through FY 2026 for TIFIA credit assistance. Each authorized dollar translates into between $14 and $20 of credit assistance, implying between $3.5 billion and $5 billion in annual lending authority. For P3 sponsors and developers, the amendments to the TIFIA statute are a mixed bag. The IIJA expands the list of projects eligible to receive TIFIA financing, including transit-oriented development and a wider variety of airport-related projects, which could be attractive as P3 projects. But the amendments also require that any public sponsor of a P3 applying for TIFIA support first conduct a value-for-money analysis or similar comparative analysis and determine the appropriateness of the public-private partnership agreement. This amendment raises timing questions, as the primary P3 contract is typically developed after the public sponsor has selected a P3 as the project delivery mode.

The IIJA also introduces a mandate that recipients of TIFIA financing (both public and private sector borrowers) require the project design builder or construction contractor to obtain payment and performance bonds. While most project sponsors already require this, the statutory amendment may reduce the potential for innovative credit performance security arrangements. The IIJA introduces provisions that are intended to streamline the application process for TIFIA loans, but these provisions apply only to transactions involving a public sector borrower.

RRIF ($250 Million)

Section 21301 of the IIJA authorizes $50 million for RRIF for each of FY 2022 through to FY 2026, provided that no more than $20 million of such authorization can be allocated to any single loan or loan guarantee. This section also authorizes $70 million for payment of credit risk premium. Unlike the TIFIA program, the RRIF has required applicants to pay upfront (i) fees to cover the cost of a financial advisor and outside counsel (total fee not to exceed 0.5% of the requested loan amount) and (ii) a credit risk premium to cover the potential cost to the government should the loan not be repaid. This requirement has deterred prospective borrowers from utilizing the RRIF program, which has funding authorization of up to $35 billion for loans and loan guarantees. For previously authorized RRIF loans, the credit risk premium may be refunded after the obligations under the RRIF loan have been repaid.

The IIJA amendments also give applicants the right to receive nonbinding estimates of the credit risk premium. This is important, as the credit risk premium in the past has been an unknown amount until very near to closing, which has impeded applicants’ financial modeling efforts. Section 21301 of the IIJA amends the RRIF statute to introduce provisions intended to streamline to 90 days the application review process for applicants seeking a loan or loan guarantee of $150 million or less. It expands and clarifies the RRIF program’s availability to finance transit-oriented development projects and landside port infrastructure. The amendments also permit final maturity dates to exceed 35 years from substantial completion where the useful life of the financed asset exceeds 35 years. For such assets, the tenor of the RRIF loan can be extended up to 75% of the incremental useful life beyond 35 years.

Provisions Directly Relevant to Public-Private Partnerships

Asset Concessions/Asset Recycling

Section 71001 of the IIJA directs the secretary of transportation to establish a program to facilitate access to expert services for, and to provide grants to, eligible public entities to enhance their technical capacity to facilitate and evaluate P3s. On October 1, 2021, the secretary of the treasury transferred to the transportation secretary $20 million for this purpose (and will transfer $20 million on each October 1 thereafter, through October 1, 2025). This section also directs the transportation secretary to submit to Congress an asset recycling report by no later than August 1, 2024. This report will include an analysis of any impediments in current laws and regulations to increased use of P3s and private investment in transportation improvements, together with proposals to address those impediments.

One Federal Decision

Section 11301 of the IIJA codifies the One Federal Decision process6 which sets a two-year time limit for completing the National Environmental Policy Act (NEPA) review and permitting processes for major infrastructure projects. Permitting reform has consistently been viewed as a critical element to improving the viability and likelihood for success of P3s in the U.S.

Value-for-Money Analysis

Section 70701 of the IIJA requires public sector applicants for TIFIA and RRIF loans for any project that has an estimated total project cost exceeding $750 million, and is located in a state that has passed P3 authorizing legislation, to conduct a value-for-money analysis to consider the relative merits of a P3 against traditional modes of project delivery.

Private Activity Bonds (PABs)

Section 80403 of the IIJA doubles the cap on PABs for surface transportation projects from $15 billion to $30 billion. PABs are a very popular source of tax-exempt financing for P3 projects, and prior to the passage of the IIJA, the aggregate of outstanding and committed PABs was approaching the $15 billion limit. Sections 80401 and 80402 of the IIJA also expand the scope of projects that may use PABs to include qualified broadband projects and carbon dioxide capture facilities.

* * *

Takeaways

Transportation infrastructure is expected to receive the lion’s share of new spending under the IIJA (approximately $269 billion, not including EVs, buses and ferries). The IIJA programs provide the majority of funding for transportation infrastructure through competitive grants, giving the U.S. DOT a very important role in directing the allocation of funds authorized by the statute. To date, the U.S. DOT has issued a number of notices of proposed rulemaking, NOFOs and guidance pursuant to IIJA provisions, but is still catching up to the pace set by certain other departments, notably the DOE.

As discussed above, the IIJA also supports the expansion of P3s in the U.S., most notably by increasing the dollar value cap of surface transportation PABs, which are a popular financing tool for U.S. P3s. More broadly, IIJA funding will allow jurisdictions to undertake and pay for planning work related to the development of P3s for transportation and other infrastructure projects.

Coming Up Next

Part II of this series will summarize the IIJA provisions related to EVs and the promotion of battery manufacturing and recycling, as well as the development and processing of critical materials needed for battery manufacturing.

_______________

1 White House Updated Fact Sheet: “Bipartisan Infrastructure and Investment Jobs Act” (August 2, 2021); White House Fact Sheet: “The Bipartisan Infrastructure Investment and Jobs Act Advances President Biden’s Climate Agenda” (August 5, 2021); White House Fact Sheet: “The Bipartisan Infrastructure Deal Boosts Clean Energy Jobs, Strengthens Resilience, and Advances Environmental Justice” (November 8, 2021); The White House’s overview of President Biden’s Bipartisan Infrastructure Law; White House Updated Fact Sheet: “Biden-Harris Administration Hits the Ground Running To Build a Better America Six Months Into Infrastructure Implementation” (May 16, 2022).

2 Funding levels reflected in this series are as shown in the May 2022 version of the White House’s “Guidebook to the Bipartisan Infrastructure Law for State, Local, Tribal, and Territorial Governments, and Other Partners.”

3 For the latest version of the guidebook, together with an IIJA program search feature, refer to the “Building a Better America” page.

4 “Executive Order on Implementation of the Infrastructure Investment and Jobs Act” (November 15, 2021); White House Fact Sheet: “President Biden’s Executive Order Establishing Priorities and Task Force for Implementation of the Bipartisan Infrastructure Law” (November 15, 2021).

5 To be eligible for IIJA funding, federal agencies are required to ensure that any federally funded infrastructure projects use U.S.-made iron, steel, manufactured products and construction materials. Waivers can be obtained if (i) applying the domestic content procurement preference “would be inconsistent with the public interest,” (ii) the types of iron, steel, manufactured products or construction materials needed are not produced in the U.S. in “sufficient and reasonably available quantities or of a satisfactory quality,” or (iii) the inclusion of iron, steel, manufactured products or construction materials produced in the U.S. will “increase the cost of the overall project by more than 25 percent.”

6 The One Federal Decision process was put in place during the Trump administration under Executive Order No. 13766, Expediting Environmental Reviews and Approvals for High Priority Infrastructure Projects, issued on January 24, 2017. President Biden later revoked Executive Order No. 13766 in his January 20, 2021, "Executive Order on Protecting Public Health and the Environment and Restoring Science To Tackle the Climate Crisis.”

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.