Takeaways

- The FCA is poised to adopt rules requiring companies with equity shares listed on the premium and standard segments of the U.K. main market to report annually on their achievement of gender and ethnic diversity targets.

- This requirement would mirror similar initiatives recently implemented in the U.S. and some Asian countries.

- Influential large institutional investors are publishing their own voting guidelines, which seek to support greater diversity on boards.

In July 2021, the U.K. Financial Conduct Authority (FCA) published a consultation paper, “Diversity and inclusion on company boards and executive committees,” laying out proposed diversity disclosure requirements expected to go into effect in early 2022 for U.K.-listed companies.

The paper noted significant gains in gender diversity on boards. In 2011, women represented only 12.5% of U.K. directors at FTSE 100 companies, but by 2020 36.2% of directors were women. However, the level of ethnic diversity remains low. In 2017, after a review found only 2% of directors of FTSE 100 companies were persons of color, the FCA set a target of at least one director of color by 2021 for FTSE 100 companies. A recently published review found that, as of April 30, 2021, 61 FTSE 100 companies reported they had met that target, 18 reported they had not and 19 did not report whether or not they had.

Details of the FCA’s Proposed Rules

The FCA paper proposes requiring U.K.-listed companies to include in their annual report a “comply or explain” statement as to whether specific targets for gender and ethnic diversity were achieved in the financial year reported on. If the goals were not achieved, companies would need to explain why they were not and what steps are being taken to reach them in the next financial year.

The proposed goals are:

- at least 40% of the board are women;

- at least one of the chair, CEO, senior independent director (SID) or CFO is a woman; and

- at least one member of the board is from a non-white ethnic minority background.

In addition to being obliged to report on these goals, listed companies would be required to provide data on the gender and ethnic diversity of their boards, senior board positions and most senior executive management.

Companies would also be encouraged to include in their annual report:

- a summary of key policies, procedures and processes to improve the diversity of their boards and executive management;

- any mitigating factors that make achieving diversity more challenging;

- any risks in meeting the targets in the next accounting period; and

- any plans to improve board diversity.

The paper stated that the policy disclosures should apply to remuneration, audit and nomination committees, and cover ethnicity, sexual orientation, disability and socio-economic background.

The consultation process ended in October 2021 and the FCA said in November 2021 that it expects to publish new rules to implement the proposals by early 2022. The new rules would apply to U.K. and overseas issuers with equity shares, or certificates representing equity shares, admitted to the premium or standard segment of the FCA’s Official List, but excluding open-ended investment companies, “shell companies” and existing exemptions for small and medium companies.

Other Jurisdictions

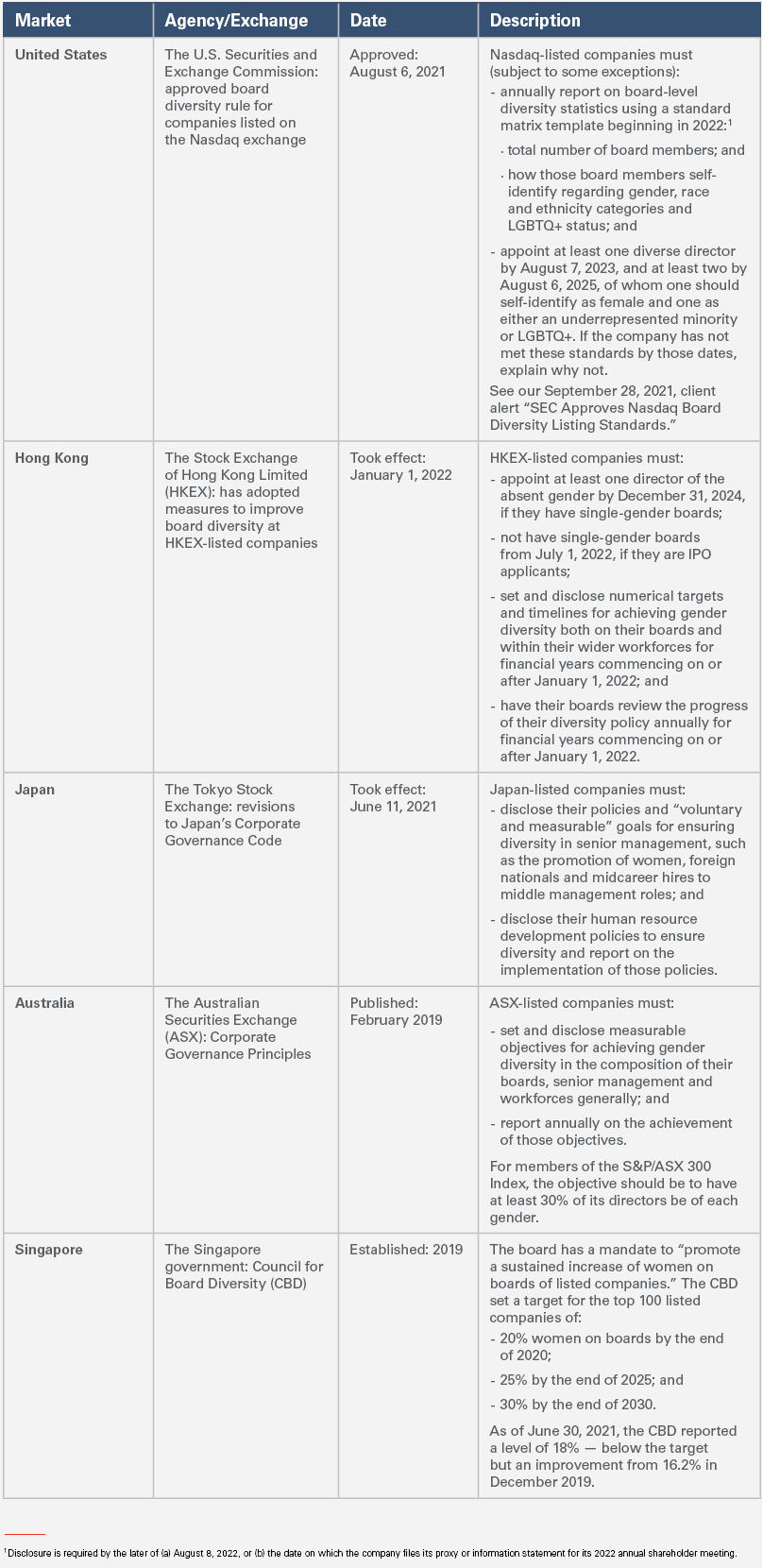

The FCA’s initiative keeps the U.K. in line with other significant financial markets, such as the U.S., Hong Kong, Japan, Australia and Singapore, each of which has taken similar steps over the past two years. (See “Investors Press for Progress on ESG Matters, and SEC Prepares To Join the Fray.”)

Investor Policies in Favor of Diversity

In parallel with these initiatives from regulators, high-profile large institutional investors are pledging to exercise their voting rights to encourage listed companies to increase diversity on their boards.

On December 2, 2021, Goldman Sachs Asset Management (GSAM) announced that, beginning March 2022, its proxy voting policies would include an expectation that each company in the S&P 500 and FTSE 100 indexes would have at least one diverse director from an unrepresented ethnic minority group on its board. GSAM also stated that it expected public companies globally to have at least two women on their boards (unless the board has 10 or fewer members or local requirements are higher than this minimum). GSAM has stated that it will enforce these expectations by voting against members of the nominating committees of companies that fail to meet them, and, in the U.S., GSAM will continue to vote against all members of boards that do not include any women.

The global push for diversity continues to gather momentum and that seems unlikely to change, not least because investors believe diversity is good for business. In announcing its new policy, GSAM was clear: “Boardroom diversity is an important source of diverse thinking at the highest level of every company and is an important driver of corporate performance.”

See all of Skadden’s 2022 Insights

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.