Takeaways

- After an initial surge in debt restructurings and insolvencies in the early stages of the pandemic, stresses eased and fewer companies sought reorganizations.

- Default rates are low, as governments have offered fiscal and monetary support and capital markets remain healthy.

- Large amounts of speculative-grade debt come due in the next several years, and borrowers’ ability to meet or refinance their obligations hinges on factors such as inflation and the strength of the global recovery, even as the pandemic continues.

The COVID-19 pandemic initially triggered a spike in business restructurings and insolvencies around the globe. According to the UCLA-LoPucki Bankruptcy Research Database, 56 large public corporations filed for bankruptcy in the U.S. in 2020 — the most in any year since the 2008 global financial crisis, and a 124% year-over-year increase. However, that was followed by a plummet in insolvency filings for a variety of reasons, including the expansionary fiscal and monetary policies adopted by many countries. Although the health effects of the COVID-19 pandemic persisted into 2021, many of the economic consequences did not. The global corporate default tally through mid-December 2021 was at its lowest level since 2014.

Over the past year, the combination of widely available government support and open capital markets has made refinancing and amend-and-extend transactions the preferred solution for many struggling companies. Borrowers have generally been able to refinance existing loans and bonds at lower cost and with extended maturities. And while 2021 saw heavy restructuring activity, it has tended to be either sector-specific (e.g., real estate, retail, travel) or situation-specific.

Government Policy Helped Avert More Business Stress

The virus has had a devastating impact on people and businesses across the globe. In October 2021, the World Health Organization reported more than 241 million confirmed cases and over 4.9 million deaths. The U.S. accounts for around one-fifth of all global cases.

Millions of people have also lost their jobs and hundreds of thousands of businesses have closed. Governments implemented lockdowns, quarantines and travel restrictions in an effort to slow transmission rates.

But, in response, governments and central banks around the world enacted robust stimulus policies, increased expenditures and lowered interest rates to avoid a catastrophic economic collapse. In the U.S., the Federal Reserve cut interest rates to near zero and implemented aggressive quantitative easing measures. Congress enacted more than $5 trillion in emergency legislation. Outside the U.S., the International Monetary Fund (IMF) reports that, in 2020, Japan for example adopted fiscal packages worth 307.8 trillion yen (approximately $2.7 trillion), or 54.9% of its 2019 GDP.

In October, the IMF updated its forecasts for the global economic growth to 5.9% in 2021 and 4.9% in 2022. However, economic recovery varies widely among countries, driven by early policy support and access to COVID-19 vaccines. Only 4% of people in low-income countries have been vaccinated, versus 60% in wealthier ones.

As economies reopen, observers are increasingly concerned about inflation in some countries. For example, at the end of 2020, the Federal Reserve estimated that U.S. inflation would average 1.8% in 2021. By September, the Fed’s estimate increased to 4.2%. Economists attribute the increase in prices to a combination of labor shortages, supply chain bottlenecks, rising costs of raw materials and the extraordinary monetary and fiscal policies adopted in response to the pandemic. At least in the U.S., inflation continues to run hot, to the degree that real (inflation-adjusted) yields on corporate bonds have plunged into negative territory for the past several months.

Speculative-Grade Debt Maturities Loom

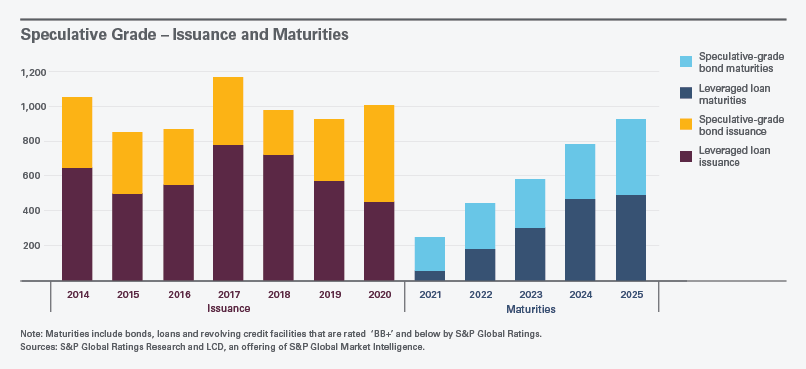

Scheduled maturities for speculative-grade debt are approximately $427 billion in 2022 and approximately $580 billion in 2023, and that figure rises in later years, reaching a peak of approximately $934 billion in 2025. The chart below shows total speculative-grade issuances and maturities through 2025 (i.e., rated BB and lower):

On the positive side, even in 2025, speculative-grade bond and leverage loan maturities are below recent years’ volume of speculative-grade bond and leveraged loan issuances, which has averaged $1 trillion annually for the past four years. In other words, unlike in past cycles, barring sustained inflation or a significant slowdown in economic growth, we do not seem to be facing an unmanageable speculative-grade debt-maturity wall. At the same time, there are record levels of “dry powder” available in private equity markets.

What To Watch in 2022

Many corporations entered the COVID-19 pandemic already highly leveraged, and corporate borrowing has only increased during the pandemic. The coming year presents new challenges as companies adapt to the withdrawal of government support and shift to focus on longer-term recovery and growth.

If, as expected, further government support is limited, companies will turn increasingly to the capital markets and existing lenders and shareholders to meet their liquidity and working capital requirements. Looking forward, observers will monitor whether lasting inflation will trigger increased interest rates and usher in the next wave of restructurings, or whether, as the IMF predicts, inflation rates prove to be transitory and return to pre-pandemic levels without a resulting increase in interest rates.

See all of Skadden’s 2022 Insights

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.