Takeaways

- Tariffs and other restrictions on trade with China are unlikely to change significantly under the Biden administration, so companies will have to adapt their operations and supply chains accordingly.

- A bipartisan consensus has developed supporting many of the Trump administration’s policies toward China.

- Trade disputes are closely linked to other strategic tensions between the U.S. and China.

The restrictions the United States and China placed on trade with each other during the Trump administration are unlikely to change significantly under the Biden administration. Over the past four years, bipartisan support developed for a more aggressive policy toward China on trade, and the countries’ trade disputes are now intertwined with strategic and human rights issues, making them more difficult to resolve.

Companies therefore need to prepare for this new normal: an extended period of tariffs, export controls and other barriers to trade and investment, particularly in high tech. The Chinese and American economies are too deeply linked to fully decouple, but some relationships will likely be unwound and new ones will be slower to form.

Our Predictions

Given the new bipartisan consensus, President Biden will be under pressure to be “tough on China.” As a result, we expect that the Biden administration will retain virtually all of the measures taken by the Trump administration against China. Here is what to expect more specifically:

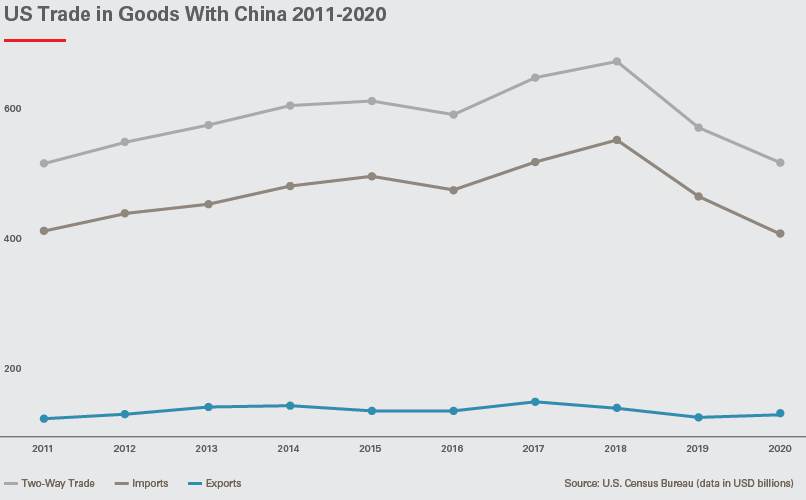

Tariffs are likely to remain in place. Approximately $370 billion of Chinese imports into the U.S. are subject to the tariffs imposed since 2018. The Biden administration is unlikely to remove or reduce these without receiving something in return. It will be difficult for China to make concessions with respect to the primary sticking points: industrial subsidies, cyber intrusions, and state direction and control over Chinese companies.

Export control measures will continue to tighten. It is unlikely that the Biden administration will remove Chinese firms from the so-called “Entity List” of companies that are severely restricted in their purchases of U.S. goods, software and technology. Moreover, recently tightened “military end use” rules impose similar controls in many cases. The new administration will also continue to identify and control “emerging and foundational technologies” that will further restrict Chinese companies’ ability to access U.S. technology. For its part, China may retaliate by using its own version of the Entity List — the “Unreliable Entities List” — against U.S. companies to block them from trading with or investing in China.

The U.S. likely will allow SMIC to buy some semiconductor technology. China’s leading semiconductor company, SMIC, was added to the Entity List in December. We do not expect the Biden administration to remove it, but, given SMIC’s importance as a supplier to many U.S. companies, we expect the government will grant export licenses for less sensitive technology that SMIC wants.

The Biden administration will emphasize human rights. In 2019 and 2020, the U.S. imposed sanctions and export restrictions on an array of entities and individuals in China, based on their activities in Xinjiang province, Hong Kong and the South China Sea, reflecting human rights and security concerns.

The new administration may take stronger action with respect to forced labor and other perceived human rights abuses. For example:

- It may take a broader approach and target companies outside of Xinjiang that allegedly use forced labor provided by “vocational centers” in Xinjiang that the U.S. claims target the province’s ethnic minorities, including Uyghurs, or have other indirect ties to the alleged use of forced labor in Xinjiang.

- Most products sourced in whole or in part from Xinjiang will likely be banned. There was strong bipartisan support for the Uyghur Forced Labor Prevention Act (UFLPA) in 2020, and similar legislation has been introduced in the new session of Congress. This legislation would create a presumption that all goods sourced from Xinjiang are made with forced labor and thus are barred from importation into the United States.

- Apart from the UFLPA, we expect U.S. Customs and Border Protection to continue and, in fact, intensify its efforts to investigate the supply chains for imports from Xinjiang and bar products that are made through forced labor.

- The impact of these measures would extend well beyond the apparel industry, which relies on cotton from Xinjiang. For example, a significant portion of the global supply of the polysilicon used in solar panels comes from Xinjiang.

- President Biden may impose sanctions on parties perceived to be undermining democratic processes and institutions in Hong Kong.

Other Restrictions Affecting Chinese Companies

The Biden administration’s policy decisions will take place against the background of other recent measures limiting Chinese operations and capital-raising in the U.S.

In August, President Trump signed executive orders barring the sale of two popular apps for Chinese internet firms, TikTok and WeChat, out of concern that the Chinese government could collect personal data of American citizens using the platforms. (Both orders were later enjoined by federal courts.)

In November, President Trump issued an executive order barring Americans from investing in the securities of companies with ties to the Chinese military. The New York Stock Exchange indicated that it would delist three Chinese telecoms companies identified by the government in order to comply. In addition, the Holding Foreign Companies Accountable Act was signed into law in December. It prohibits a foreign company’s securities from being listed or traded on U.S. exchanges if the company’s financial statements are not subject to inspection by the U.S. Public Company Accounting Oversight Board for three consecutive years beginning in 2021 — inspections that China thus far has not allowed.

In early January, President Trump issued an executive order banning transactions with eight additional Chinese apps, including Alipay.

The Future for US and Chinese Companies

Supply chains will be altered indefinitely. Since U.S. tariffs are likely to remain in effect for some time, American companies that have not already altered their sources of supply will need to consider changes. In many cases, that will entail finding new suppliers in countries such as Vietnam, Thailand and Mexico, either on an exclusive basis or as parallel “China-plus-one” alternatives. Measures such as the UFLPA, export controls and sanctions may also necessitate changes to American companies’ supply chains.

For their part, Chinese companies will continue to explore ways to become less reliant on U.S. technology, given the tightening of U.S. export controls.

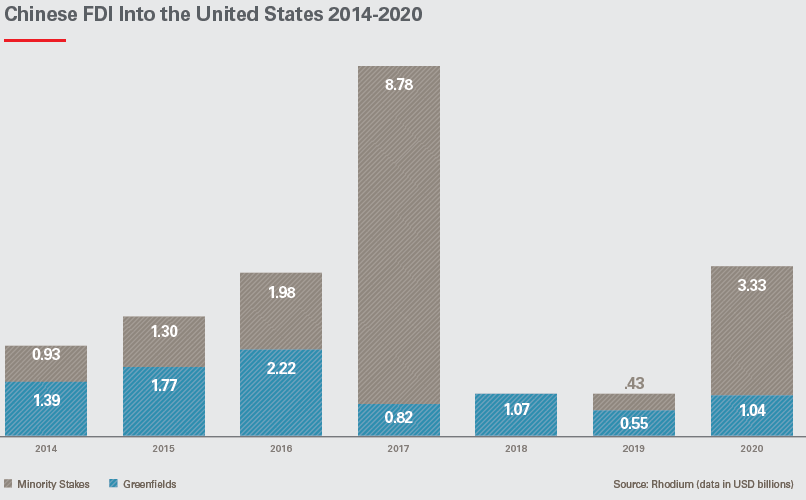

Chinese investment in the United States will remain at relatively low levels. Since the onset of the trade war, Chinese investment in the U.S. has plunged, and it is likely to remain at relatively low levels for some time. In part, the drop reflects an expansion since 2018 of the authority of the Committee on Foreign Investment in the United States (CFIUS), which reviews foreign investments on national security grounds. CFIUS has recommended blocking or unwinding several Chinese investments in recent years, which has had a chilling effect.

We expect that Chinese investors will primarily invest in the U.S. market through passive minority stakes in investment funds, certain forms of venture capital and greenfield operations, which are not subject to CFIUS reviews. Lower levels of Chinese investment may create opportunities for investors from other countries.

* * *

View other articles from this issue of The Informed Board

- Why Does the Brand of My Phone Affect My Credit Rating?

- A Practical Guide to the Role of Directors in Fighting Ransomware

- The Brexit Deal Leaves Some Mighty Big Holes

- ESG: Many Demands, Few Clear Rules

- New Tactics and ESG Themes Take Shareholder Activism in New Directions

- How Far Can the SEC Go? (Audio Interview)

See all the editions of The Informed Board

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.