Despite the global economic and health crisis resulting from the COVID-19 pandemic, many companies have continued to intensify their efforts to improve their management approaches and communications in relation to environmental, social, and governance (ESG) issues. In many instances, the ongoing crisis has, in fact, accelerated pre-existing trends towards greater ESG integration by underscoring the role of business in confronting wider societal issues.

The increasing adoption of ESG management systems is driven by two concurrent trends. First, significant social pressures, a shift in expectations for private enterprise, and ongoing regulatory changes have increased demand for companies to proactively take responsibility for potential externalities affecting the environment and society. Second, there is a growing recognition amongst investment and business professionals that ESG issues can have a material impact on company value and that the management of such risks can preserve (and even enhance) economic value for companies and their shareholders.

In this article, we review the underlying trends behind the momentum in ESG management and examine potential shifts in public policy, investor sentiment, and company behavior in the ongoing aftermath of the COVID-19 crisis. We draw some early lessons for companies reconsidering their approach to ESG as a result of the pandemic, focusing on social inequalities and workforce risks, the acceleration of pre-existing economic trends, and a continued emphasis on ESG issues.

Social Pressures Create Heightened Awareness of ESG Risks

As global social and environmental challenges become more acute, it is apparent that responding to these challenges requires coordination amongst multiple actors at a scale greater than national and local governments are able to undertake on their own. There is a growing consensus among policymakers, public policy advocates, and market participants (including companies and investors) that private enterprise will need to become part of the solution, beyond merely complying with laws and regulations.

Stakeholder awareness of the impact of corporations on society and the environment also is changing at the grassroots level as consumers, employees, and local communities become more vocal about their concerns. Consumer consciousness around these issues — from packaging and single-use plastics to concerns about the carbon footprint of meat production or labor conditions in apparel manufacturing — may affect a wide range of industries, and the public’s participation in the debate has become more prevalent through the use of social media and other communication platforms. This has been intensified by the COVID-19 crisis as companies have attempted to navigate the unique and immediate social issues that have arisen. There is, for example, a heightened awareness of the need to develop workplace health and safety procedures to protect employees, and executive pay is under greater scrutiny in the context of mass furloughing, reduced working hours, job losses and salary cuts.

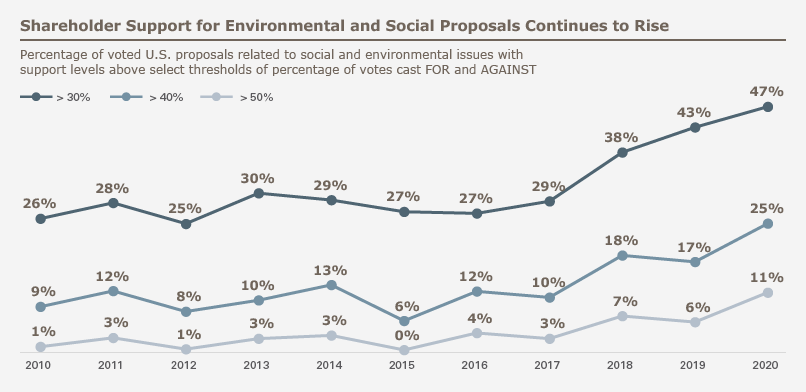

Stakeholders also are becoming increasingly familiar with the available tools through which they can engage with companies and advocate for change in corporate behavior, including through shareholder resolutions, lobbying activities, PR campaigns, employee initiatives, and online petitions. This year’s annual general meeting (AGM) season appears to have seen a noticeable increase in the number of shareholder-proposed resolutions achieving a high level of support from investors. Although such resolutions typically are advisory rather than binding in nature, strong backing from investors sends a clear message to boards of directors and management teams.

As public opinion becomes more sensitive to social and environmental issues and more receptive to scrutiny of corporate practices, companies, investors, and other market participants are likely to become increasingly aware of the potential financial and reputational impacts of ESG management.

Regulatory Changes Set the Framework for Companies and Investors

In the public policy sphere, the United Nations is among the leading organizations coordinating global policy efforts for environmental stewardship, social responsibility, and economic development, with a significant emphasis on private sector involvement. The U.N. Sustainable Development Goals (U.N. SDGs) serve as one of the primary initiatives linking corporate activity to solutions to major environmental and social policy issues. Similarly, the 2015 Paris Agreement within the United Nations Framework Convention on Climate Change commits global governments to policies that involve regulatory frameworks for businesses and financial institutions with the ultimate objective of addressing climate change.

In Europe, often seen as a trendsetting region for ESG issues for both investors and companies alike, the European Union is in the process of adopting a series of regulations intended to: (i) establish a reliable environmental classification framework (the Taxonomy Regulation); (ii) require companies and financial market participants (such as private funds) to implement policies and disclose to investors how ESG factors are being integrated into investment decisions and internal processes (the Sustainability-Related Disclosure Regulation); and (iii) facilitate the disclosure of reliable, comparable and relevant ESG information by companies (the proposed amendments to the Non-Financial Reporting Directive). The ongoing implementation of the amended Shareholder Rights Directive also will improve the transparency of the voting policies and procedures of fund managers and make it easier for shareholders to exercise their rights by encouraging the use of modern technology to ease communication between companies, their shareholders and the intermediaries between them.

New Investor Expectations Drive ESG Momentum

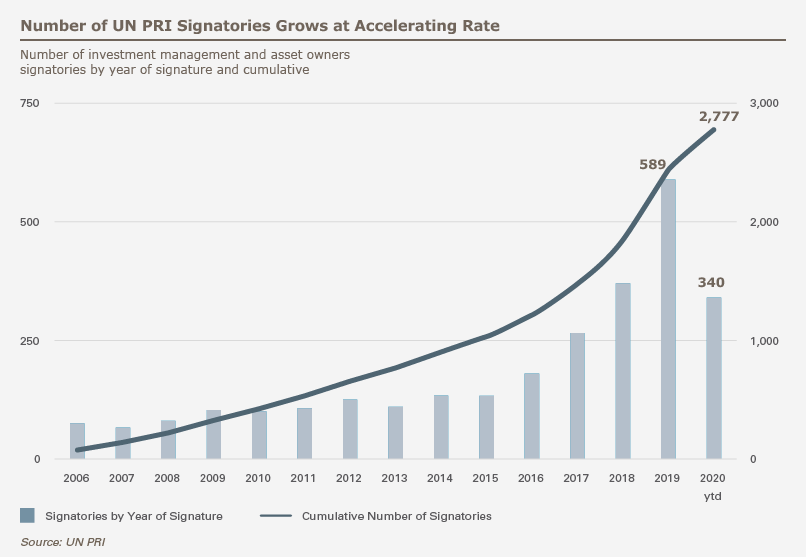

While social pressures and regulatory changes have influenced company behavior in relation to specific topics of interest to individual stakeholders, the continued rise of investment stewardship — a movement that encourages investor engagement with companies to promote corporate governance practices that are consistent with long-term value creation — has served as the biggest driver for the widespread adoption of ESG programs and disclosures over the past decade. This has endured and, in many cases, intensified during the COVID-19 crisis. For example, State Street’s CEO published stewardship engagement guidance in April encouraging companies to maintain a long-term view and communicate effectively with investors. In its H1 2020 Stewardship Report, AXA IM reported more engagement with companies in a six-month period than ever before as it “doubled down” on its engagement activities relating to public health, workforce management, and shareholder rights, engaging with 181 issuers during the lockdown period and voting in 4,300 shareholder meetings. Investor stewardship initiatives arose and gained significant momentum across multiple jurisdictions, including through international efforts such as the United Nations Principles of Responsible Investment (U.N. PRI), whose number of signatories ballooned in the decade following the 2008 financial crisis, and through more localized efforts such as the UK Stewardship Code, which underwent significant revision this year, or the activities of the Investor Forum, which continues to facilitate dialogue between institutional investors and companies. As investors made firmer commitments to stewardship, the “ESG” acronym became widely used in the investment community to capture asset managers’ efforts to systematically incorporate risks that typically reside outside a company’s financial statements and have broader societal implications.

The ‘New Normal’

In recent years, large institutional investors have made their demands for consistent ESG disclosures more explicit and many have made calls for the adoption of standardized reporting frameworks, such as the Sustainability Accounting Standards Board (SASB) standards and the Task Force on Climate-related Financial Disclosures (TCFD) framework. Among the growing chorus of investors encouraging companies to provide standardized disclosures on ESG issues, the world’s three largest asset managers — BlackRock, Vanguard, and State Street — have not only endorsed reporting frameworks but have also committed to more active engagement with portfolio companies to address material risks. For example, in July 2020, BlackRock announced that it had taken action by voting against the management of 53 of its portfolio companies due to insufficient action in integrating climate risk into their business models or disclosures, and identified an additional 191 companies with problematic or insufficient climate-related practices that it will continue to monitor during the following year. Earlier in the year, in a letter about the 2020 voting agenda, State Street’s CEO informed market participants about the asset manager’s plans to take action against the boards of companies that underperformed in ESG management.

This increased pressure by investors is pushing companies to provide more detailed disclosures that focus on the management of ESG issues. Companies are expected to explain their process for identifying material ESG risks, as well as their oversight mechanisms and management systems for addressing such risks. Similarly to the management of financial objectives, a growing number of companies are setting targets and using key performance indicators to demonstrate their progress towards achieving their goals. Heightened expectations around ESG management create both a “carrot” and “stick” for market participants (including companies and investors) as performance on ESG issues can impact access to capital, talent, and business opportunities. As ESG disclosure becomes more detailed and standardized, companies should expect their investors to be increasingly alert to any potential “greenwashing” as they seek to distinguish fact from fiction.

The Impact of the COVID-19 Crisis on ESG Management: Three Key Lessons

These pressures, changes, and expectations set out above have carved the path for a “new normal” in ESG management, where both companies and investors have begun to use ESG management as a key differentiator and as a tool for monitoring and managing risks. Indeed, many investors are taking a more proactive approach to the monitoring and management of ESG risks, as their engagement efforts with companies are no longer limited to financial performance, reactions to controversies, crises, or shareholder resolutions requesting company action or disclosure related to environmental and social issues. Instead, investor engagement increasingly is focused on policy gaps, oversight mechanisms, and performance metrics, irrespective of whether such issues are on the ballot of an annual general meeting.

There are numerous examples of significant events and crises that have served as watershed moments in the development of ESG management, leading to increased scrutiny, regulation or market initiatives to address systemic gaps in addressing key risks — the accounting scandals of the early 2000s, the 2008 financial crisis, several corporate environmental disasters, significant data breaches and data privacy incidents, the 2015 Paris Agreement on Climate Change, and the rise of awareness of workplace harassment through the #MeToo movement, to name but a few. The unprecedented economic and health crisis we are currently experiencing as a result of COVID-19 seems likely to serve as a similar watershed moment and have a profound impact on how companies and investors view and address ESG issues in the future. We draw three early lessons from the COVID-19 crisis in relation to ESG management:

- Social inequalities and workforce risks have been exposed. One of the most visible effects of the crisis has been the rapid exposure of significant risks to the most vulnerable groups of society. Many employees in lower-paid jobs have experienced layoffs on a significant scale and, in a number of countries including the United States, a lack or loss of health insurance coverage when they most need it. At the same time, many low-paid employees in a wide range of industries — including healthcare, elder care, food manufacturing, distribution for online retailers, and grocery stores — who are now deemed “essential workers” have kept their employment but have been most exposed to COVID-19 in the workplace. The pandemic has disproportionately affected minorities and people of color, and the tragic killing of George Floyd brought to the foreground concerns about systemic racial biases, and inequalities around the globe. The COVID-19 crisis has put the “S” in ESG firmly at the center of the discussion and many companies should consider intensifying their efforts to manage health and safety, address diversity and inclusion, and engage with communities.

- Preexisting economic trends have rapidly accelerated. While the global pandemic appears to have hit the pause button on economic activity and millions of people feel like they have put their lives on hold due to social distancing measures, the ongoing crisis has triggered the rapid acceleration of preexisting economic trends that may radically change the way we do business and live our lives. These trends include digitalization, decarbonization, automation, e-commerce, and agile working, each of which has moved forward as a result of the crisis. These new realities have significant implications for several ESG issues, including data security, data privacy, workforce management, diversity and inclusion, and supply chain management, and how companies adapt their business in response to these trends is likely to be a determining factor in their ongoing success.

- ESG is here to stay. The ongoing crisis proves that ESG management can have material financial and reputational implications and will not only survive the economic shock of the COVID-19 pandemic but likely will become more engrained in business management and communications. Despite the economic challenges stemming from the pandemic, neither companies nor investors appear to have reduced their efforts to bolster their ESG management programs and communications. According to Morningstar, ESG funds continued to experience net inflows at a record pace through the second quarter of 2020, while they also appear to outrank conventional peer funds, according to another Morningstar report. At a minimum, this contradicts the view that ESG is just a fad of the boom market or that sustainable investment comes with the trade-off of poorer performance.

Businesses, private markets, and capital markets have passed the point of no return in terms of ESG adoption. The ongoing global crisis is expected to push companies and investors further to develop and improve their management approaches and communications in relation to ESG risks, boosting the dramatic surge in activity around the globe. In light of this new reality, companies that are slow in evolving their ESG programs should expect tougher conversations in the future with their shareholders and other key stakeholders.

This article was drafted in collaboration with FTI Consulting.

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.