The Treasury Department and the Internal Revenue Service (IRS) recently released much-anticipated proposed regulations, as well as a related revenue ruling (Rev. Rul. 2018-29), concerning opportunity zone investments.

In our previous client alert, “Opportunity Zone Funds Offer New Tax Incentive for Long-Term Investment in Low-Income Communities,” we outlined the basic rules governing investments in opportunity zones and identified a number of issues that were outstanding at the time. The proposed regulations address — in a pragmatic, policy-oriented fashion — a number of key issues, including:

- the ability of taxpayers who are members of pass-through entities to “roll over” qualified gain amounts recognized through those entities;

- the ability of existing entities to become opportunity zone funds (OZ funds);

- the capital expenditure requirements applicable to certain real estate development and redevelopment projects;

- the ability of real estate development companies to hold cash during the development phase; and

- the extent to which a portfolio company owned by an OZ fund (an “OZ portfolio company”) can own tangible property that is not qualified opportunity zone business property (QOZBP).

The overall tenor of the proposed regulations is economic flexibility, and to that end, the proposed regulations are helpful to investors. If subsequent guidance follows this pattern, the regulations package will help further the policy goals underlying the opportunity zone regime.

Although the regulations will become effective once finalized, a taxpayer may generally rely on them prior to their finalization as long as the taxpayer applies the rules in their entirety and consistently.

Below, we summarize the key points of guidance provided in the proposed regulations and in Rev. Rul. 2018-29 as well as some of the important open questions that will need to be addressed in future guidance.

Key Provisions of the New Regulations

Who Is the Taxpayer? As discussed in our prior client alert, the statute was susceptible to multiple interpretations of the term “taxpayer,” some of which would have severely restricted the number of investors eligible to make tax-advantaged investments in OZ funds. The proposed regulations clarify that a broad class of investors is eligible for benefits under the opportunity zone regime. Generally speaking, any taxpayer that recognizes capital gain is eligible to defer that gain by “rolling” it into an OZ fund. As a result, individuals, C corporations (including real estate investment trusts (REITs) and regulated investment companies (RICs)), partnerships, S corporations and certain other pass-through entities (including common trust funds and qualified settlement funds) are all eligible taxpayers.

More importantly, the proposed regulations provide for added flexibility when a partnership or S corporation is the seller of an appreciated asset. Under the regulations, the partnership itself may invest in an OZ fund, but if the partnership does not elect to do so, each individual partner may invest its allocable share of the qualified gain amount in an OZ fund. Thus, the proposed regulations give each partner in a partnership the flexibility to make its own decision about whether to roll its gain into an OZ fund. Given that taxpayers frequently recognize gains through partnerships as opposed to directly, this was an extremely important clarification and is likely to spur additional investment in OZ funds.

OZ Fund. The statute requires that an OZ fund be “organized” as a corporation or a partnership. The statutory language caused taxpayers to question whether a state law limited liability company could serve as an OZ fund and whether an existing entity (as distinguished from a newly formed entity) could be an OZ fund. The proposed regulations allow any entity that is classified for federal income tax purposes as a corporation or partnership to serve as an OZ fund, regardless of its state law juridical form. Further, the proposed regulations clarify that existing entities can be OZ funds, meaning that investors can restructure entities rather than have to create newly formed entities to serve as OZ funds.

Qualified Gains. Prior to the issuance of the proposed regulations, it was unclear what types of “gain” could be rolled into an OZ fund. For example, if gain on an asset sale was characterized as ordinary income as a result of depreciation recapture or other special rules, it was unclear whether the ordinary income could be invested in an OZ fund. It was also unclear how mark-to-market gains would be treated.

Under the proposed regulations, gain is eligible for deferral only if the gain is treated as capital gain for federal income tax purposes. Gain treated as ordinary income thus does not appear to be covered, although net capital gains from Section 1256 contracts are qualified gains, subject to certain limitations related to straddles. Exceptions to the general capital gain rule include gain from the sale or exchange of an asset with a related person1 and gain from the sale of certain hedging transactions. The language “treated as capital gain” implies that the capital gain need not arise from an actual sale of property and could include gains deemed recognized. Examples of such gain include gain from the redemption of a partnership interest, gain from the repayment or refinancing of a partnership liability and gain from return-of-capital distributions by a corporation in excess of the shareholder’s tax basis in its corporate stock. In those cases, the taxpayer would likely need to be unrelated to the partnership or corporation to be eligible to defer the gain.

The proposed regulations also clarify that qualified gain amounts can include a taxpayer’s gain on the sale of all or a portion of its interest in an OZ fund, confirming that a taxpayer may “roll” from one OZ fund to another, or back into the same OZ fund.

Time Period to Invest. A taxpayer must invest its qualified gain amount in an OZ fund within 180 days of realizing those gains. The proposed regulations clarify when that period begins and ends in the case of certain types of gains realized by taxpayers as a result of holding interests in partnerships, S corporations, REITs, RICs and trusts. Building on the flexibility noted above, the proposed regulations provide that Skadden Partnersin partnerships that have qualified gain amounts but do not to make an OZ fund investment at the partnership level can elect to start the 180-day clock to invest the sale proceeds in an OZ fund at the partner level at either: (i) the last day of the partnership’s taxable year in which the partner’s allocable share of the qualified gain amount is taken into account or (ii) the date the partnership sold the asset.

To illustrate the flexibility of this election, if a calendar-year partnership sold an appreciated capital asset on January 1, 2019, but did not elect to make an OZ fund investment, one partner could invest its allocable share of the gain in an OZ fund within 180 days of December 31, 2019, by making the election described in clause (i) of the preceding sentence, while another partner could invest its allocable share of the gain in an OZ fund within 180 days of January 1, 2019, by making the election described in clause (ii) of the preceding sentence. Although the flexibility of the election is welcome, taxpayers need to beware of a potential trap for the unwary. In the example above, the two potential partner-level investment windows are: (i) January 1, 2019, through June 30, 2019, and (ii) December 31, 2019, through June 29, 2020. These two windows leave a six-month period — July 1, 2019, to December 30, 2019 — in which neither the partnership nor its Skadden Partnersare permitted to invest qualified gain amounts in an OZ fund. This is a critical point, as the partnership rule has been described as providing an OZ fund investment period of up to 18 months, which is not entirely accurate. At most, there are two six-month investment windows with a six-month “hole” between them, during which tax-advantaged OZ fund investments may not be made. The proposed regulations provide an analogous rule for S corporations, trusts and estates.

For RIC and REIT shareholders, qualified gain amounts include both capital gain dividends and undistributed capital gain dividends. The 180-day clock for such shareholders begins on the date the dividend is paid or, in the case of undistributed capital gain dividends, the last day of the RIC or REIT’s taxable year. Given that REITs and RICs typically do not need to designate a dividend as a capital gain dividend until after the end of the taxable year, in many cases the taxpayer’s 180-day period with respect to a REIT or RIC capital gain dividend may expire before the date on which the dividend is designated as a capital gain dividend by the RIC or REIT. Accordingly, the rule starting the 180-day clock on the dividend date may need to be modified slightly in order to carry out the intent behind the provision.

Capital Structure. The proposed regulations allow for the capital structure of an OZ fund to include preferred stock or partnership interests with special allocations. This proposed rule allows for preferred and common interests, carried interest, complicated waterfalls and similar arrangements as an organizational matter. The effect of non-pro rata distributions made before year 10 remain unclear. Under the New Markets Tax Credit regime, certain non-pro rata distributions in excess of cash flow are viewed as abusive; it is unclear if they will be viewed as problematic under the opportunity zone regime.

Substantial Improvements and Land. In order for an OZ portfolio company to qualify as a qualified opportunity zone business, substantially all of its tangible assets must be QOZBP. QOZBP is tangible property that meets certain requirements, one of which is that either the original use of the property in the opportunity zone began with the OZ fund or the OZ fund “substantially improved” the property by making capital expenditures in an amount at least equal to the initial cost basis of the property within any 30-month period after the property’s acquisition. The proposed regulations and Rev. Rul. 2018-29 clarify how these rules apply when an OZ fund purchases land with an existing building. Importantly, the “original use” requirement does not apply to the land, and only the basis of the building is taken into account for the “substantial improvement” requirement.

As an example, assume an OZ fund purchases a property located in an opportunity zone for $1,000, with $600 allocable to land and $400 allocable to an existing building. In that event, the land portion is not taken into account for the original use requirement, nor must it be separately improved, and the OZ fund need only expend $400 improving the existing building to satisfy the “substantially improved” requirement. In other words, if the OZ fund invested $401 to improve the building, 100 percent of its assets would be QOZBP. The implications of Rev. Rul. 2018-29 are especially important for opportunity zone investments in urban areas, where a large portion of the purchase price is likely to be allocated to land.

Although it appears that this rule was intended to be taxpayer-favorable, it can produce unexpected results in certain circumstances. For example, assume the taxpayer in the above example spent $399 improving the building and $2 to improve the land (e.g., by resurfacing the parking lot, adding roads or sewers, etc.), or to build another building or structure on the land. Although the OZ fund would have invested $401, the OZ fund arguably would not have met the “substantial improvement” requirement as to the building because the $2 expended for the land would arguably not count toward the $401 capital expenditure requirement on the building. This result may have been unintentional, but taxpayers should exercise caution pending a clarification of the rule.

A related open question is whether the “substantial improvement” requirement can be met by demolishing an existing building and constructing a new one. For example, taking the same facts as the above example, if the $400 building was demolished at a cost of $20 and a new building was constructed in its place for $381, it is unclear whether the new construction would satisfy the substantial improvement requirement.

Start-Up Businesses. The proposed regulations contain helpful rules and safe harbors for certain start-up businesses. As mentioned in our prior client alert, 90 percent of an OZ fund’s assets must be qualified opportunity zone property (QOZP), including stock or partnership interests in an OZ portfolio company. An OZ portfolio company cannot hold cash or other financial assets in excess of current reasonable working capital needs if the excess represents more than 5 percent of its assets. Although the statute does not define “reasonable working capital,” the proposed regulations provide a safe harbor under which amounts will be deemed to be reasonable working capital if each of the following requirements is satisfied:

- The amount is designated in writing for the acquisition, construction and/or substantial improvement of tangible property within the opportunity zone;

- The portfolio company prepares a written schedule that provides for the expenditure of the amount within 31 months of the OZ portfolio company’s receipt thereof and is consistent with the ordinary start-up of a trade or business; and

- The working capital assets are actually used in a manner that is “substantially consistent” with the previous two requirements.

Another helpful clarification for start-ups is that any gross income derived from reasonable working capital is counted toward the requirement that 50 percent of an OZ portfolio company’s total gross income be derived from the active conduct of the opportunity zone business. Thus, if during the start-up phase an OZ portfolio company’s only gross income is derived from its reasonable working capital (e.g., bank account interest), then 100 percent of its gross income will be deemed derived from an active trade or business in the opportunity zone, which would satisfy the 50 percent income test.

QOZBP and Definition of “Substantially All.” Under the statute, substantially all of the tangible property (if any) that an opportunity zone business owns or leases must be QOZBP. The proposed regulations helpfully draw a bright line for the “substantially all” test, providing that the test will be satisfied if at least 70 percent of tangible property owned or leased by the business is QOZBP. Among other benefits, the 30 percent cushion provided by this rule allows an OZ portfolio company to acquire a limited amount of tangible assets that do not satisfy the acquired-by-purchase requirement. This could include, for example, assets purchased from a related party, assets that have been acquired via a tax-free contribution to the OZ portfolio company by a non-OZ-fund partner2 or assets that will be used to support expansion activities outside the opportunity zone.

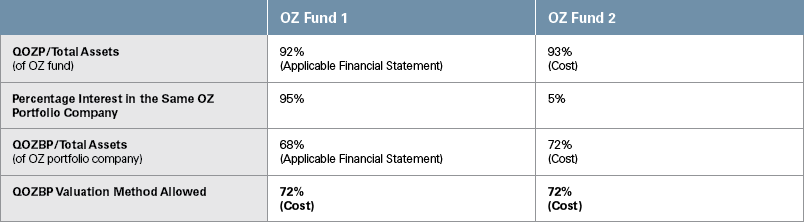

Asset Valuation. As noted above, at least 90 percent of an OZ fund’s assets must be QOZP. The method of valuing assets for this purpose will differ for those taxpayers that prepare certain financial statements in accordance with U.S. generally accepted accounting principles (GAAP) (Applicable Financial Statement)3 and those that do not. The former group must use the value of each asset as reported on its Applicable Financial Statement; the latter group must use the cost of the asset to the OZ fund. The same rule applies for determining whether an OZ portfolio company in which an OZ fund invests satisfies the 70 percent QOZBP asset rule at the OZ portfolio company level, as described above. Given the potential differences between U.S. GAAP reporting and cost, different OZ funds could be subject to significantly different testing requirements depending on whether they have an Applicable Financial Statement.

Generally speaking, an OZ fund must value the assets of an OZ portfolio company for purposes of determining whether the OZ portfolio company satisfies the 70 percent QOZBP asset rule. If the OZ portfolio company has an Applicable Financial Statement but the OZ fund does not, the OZ fund will use the OZ portfolio company’s asset values reported on its Applicable Financial Statement to determine compliance with the 70 percent QOZBP asset rule at the OZ portfolio company level. If the OZ portfolio company does not have an Applicable Financial Statement, but two or more OZ funds own at least 5 percent of the OZ portfolio company, the regulations allow each OZ fund to use either the valuation methodology that applies to its own OZ fund compliance or the valuation methodology that applies to the other OZ fund’s compliance, whichever results in the highest percentage of QOZBP for the OZ portfolio company. The table below provides a numerical example of this rule in a situation in which the OZ portfolio company does not have an Applicable Financial Statement:

Because OZ Fund 2’s methodology causes the OZ portfolio company to meet the requirements outlined above, OZ Fund 1 may use OZ Fund 2’s valuation method for purposes of testing the 70 percent QOZBP asset rule at the OZ portfolio company level. As a result, the OZ portfolio company is able to comply with the 70 percent QOZBP asset rule, although it would not have if it had used OZ Fund 1’s asset valuation as reported on its Applicable Financial Statement.

Clarification of 10-Year Rule. All current opportunity zone designations are set to expire on December 31, 2028. This expiration date leaves two open questions: (i) whether a taxpayer that acquires its OZ fund interest after 2018, and thus has to hold that interest beyond 2028 to achieve a 10-year holding period, can qualify for the exemption from tax on the sale of OZ fund interests held for 10 years (the “OZ tax exemption”), and (ii) how long a taxpayer could hold its OZ fund interests beyond 10 years. The proposed regulations address both questions. A taxpayer will generally be eligible for the OZ tax exemption even if it sells its OZ fund interest after 2028, at a time when the area is no longer designated as an opportunity zone. The exemption continues to be available as long as the disposition of the OZ fund interest occurs before December 31, 2047. Accordingly, a taxpayer that invests in an OZ fund in 2026 (the last year a gain deferral election can be made) can hold its investment for the required 10-year holding period and an additional 10 years. This should provide taxpayers with comfort that they will not be forced to sell at an economically inopportune time to take advantage of the OZ tax exemption.

Areas Still in Need of Guidance

Although the proposed regulations address many important issues, certain questions remain open. Consistent with Treasury’s prior public statements, the preamble to the regulations suggests that Treasury intends to engage in one or more rounds of future rulemaking. It would be helpful to taxpayers seeking to invest in opportunity zones if such future guidance addressed the following notable issues.

Interaction With Subchapter K. The statute provides that a taxpayer’s basis in its OZ fund interest is zero, except to the extent necessary to reflect the recognition of deferred qualified gain amounts, the reduction in that deferred gain for OZ fund interests held for at least five years and the OZ tax exemption. As we noted in our previous client alert, the statute does not expressly provide for other adjustments to the taxpayer’s basis under the normal partnership rules of Subchapter K. The proposed regulations do not address this issue or most other issues relating to the interaction between the opportunity zone provisions and Subchapter K. They do, however, clarify that a partner’s deemed contribution of money resulting from an allocation of a partnership liability to that partner does not create a new investment in the OZ fund; thus, the portion of the taxpayer’s OZ fund interest that is eligible for opportunity zone tax benefits would not change as a result of the deemed contribution.

The proposed regulations also clarify that a taxpayer that is allocated debt from an OZ fund cannot treat the amount of the OZ fund debt allocation as a rolled-over gain amount. For example, if a taxpayer wants to roll $100 of qualified gain into an OZ fund, the taxpayer must actually contribute $100 of cash to the OZ fund and cannot rely on deemed contributions resulting from debt allocations to reduce the amount that it must actually contribute. This dynamic may either incentivize OZ fund investors to capitalize their OZ funds with equity rather than debt or, if they choose to use debt leverage for business reasons, reduce the extent to which an investor is able to roll gain into an OZ fund.

Exit. As written, the statute provides that the OZ tax exemption for OZ fund investments held for at least 10 years applies only if the investor sells its interest in the OZ fund. In other words, the exemption appears not to apply when the OZ fund sells interests in an OZ portfolio company or an OZ portfolio company sells its underlying assets. The proposed regulations do not provide any additional relief on this issue. Accordingly, it is still prudent for taxpayers to structure OZ funds in a manner that allows for an exit through a sale of OZ fund interests — for example, by creating a new OZ fund for each asset or group of assets that are expected to be sold together.

Certain Start-Up Issues. Although the safe harbor for reasonable working capital described above is helpful to businesses whose assets consist primarily of tangible assets in the opportunity zone, guidance is needed on the reasonable working capital needs of other business, such as service businesses that intend to use their working capital to pay employees and contractors. In addition, for businesses that are capable of utilizing the safe harbor, some questions remain, e.g., the extent to which a taxpayer — to address unanticipated circumstances or otherwise — could deviate from its written plan while still remaining “substantially consistent” with such plan, and the extent to which a plan could be revised or updated without disqualifying an OZ fund.

Original Use. The proposed regulations intentionally leave open guidance on the “original use” requirement for QOZBP other than land acquired together with a building. As we discussed in our previous client alert, it may be impossible for an OZ fund or an OZ portfolio company to establish that it is the first to use a property in the opportunity zone. For example, if an OZ business were to acquire a fleet of refurbished delivery trucks, it would be impossible for the OZ business to establish that the trucks were never used in the opportunity zone by any prior owner or lessee of the trucks. Treasury and the IRS are soliciting comments on all aspects of the “original use” requirement, including whether the requirement can be satisfied for property that has been vacant for a period of time.

Leased Property. The language of the statute creates a number of technical questions related to property that an OZ fund or OZ portfolio company leases from others rather than owning. For example, to what extent do the “acquired-by-purchase” and “original use”/”substantial improvement” requirements apply to leased property, and how must a taxpayer think about valuing leased property (or its leasehold interest) for the various opportunity zone requirements? The new proposed regulations do not address these questions explicitly. Given that many new businesses will prefer to lease property rather than own it outright, the resolution of these types of questions will likely determine the extent to which the opportunity zone regime will facilitate the creation of new non-real estate development businesses.

Conclusion

The proposed regulations represent a much-welcomed and helpful first step in the guidance process. It is encouraging that the proposed regulations largely grant potential opportunity zone investors flexibility in how to structure investments into an OZ fund. Treasury and the IRS’ guidance will further invigorate already strong investor interest in opportunity zone investments. Resolution of the additional outstanding uncertainties in future guidance could lead to a workable regime that will benefit not only opportunity zone investors but also the communities in the opportunity zones.

_______________

1 In general, two persons are related to each other for purposes of the opportunity zone rules if one directly or indirectly owns more than 20 percent of the other, or if the same persons directly or indirectly own more than 20 percent of both, taking into account certain constructive ownership rules.

2 An OZ fund generally could not contribute property in-kind to an OZ portfolio company without creating 90 percent asset test issues at the OZ fund level.

3 The proposed regulations borrow the definition of an Applicable Financial Statement from Treas. Reg. § 1.475(a)-4(h), which defines the term as: (i) a financial statement that is prepared in accordance with U.S. GAAP and that is required to be filed with the SEC, such as the 10-K or the Annual Statement to Shareholders; (ii) a financial statement that is prepared in accordance with U.S. GAAP and that is required to be provided to the federal government or any of its agencies other than the IRS, if significantly used in the business; and (iii) a certified audited financial statement that is prepared in accordance with U.S. GAAP; that is given to creditors for purposes of making lending decisions, given to equity holders for purposes of evaluating their investment in the eligible taxpayer or provided for other substantial nontax purposes; and that the taxpayer reasonably anticipates will be directly relied on for the purposes for which it was given or provided, if significantly used in the business.

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.