In this month's edition of our Privacy & Cybersecurity Update, we examine Brazil's new data protection regulation, the French data protection authority's warning to two companies of potential GDPR violations and the U.S. Department of Homeland Security's announcement of a new cybersecurity center aimed at public-private coordination. We also take a look at the Sixth Circuit's decision involving insurance coverage for social engineering fraud and the data protection adequacy agreement between Japan and the European Union.

Brazil Passes Its First General Data Protection Law

French Data Protection Authority Issues Warning to Two Companies for Potential GDPR Violations

DHS Announces New Cybersecurity Center Aimed at Public-Private Coordination of Cyber Operations

Sixth Circuit Says Policyholder’s Social Engineering Loss Covered by Computer Fraud Policy

Japan and EU Announce Adequacy Decision

Brazil Passes Its First General Data Protection Law

Brazil has enacted a new data protection law modeled on the European Union's General Data Protection Regulation.

On July 10, 2018, Brazil's Federal Senate (Federal Senate) unanimously approved the country's first General Data Protection Law (Lei Gerald de Proteção de Dados, or the LGPD),1 which was signed into law by Brazilian President Michel Temer on August 14, 2018. Much like the European Union's General Data Protection Regulation (GDPR), the LGPD establishes a comprehensive data protection system in Brazil and imposes detailed rules for the collection, use, processing and storage of electronic and physical personal data. The regulation will go into effect in February 2020.

Key Elements of the LGPD

Personal Data

Like the GDPR, the LGPD broadly defines "personal data" to include any information, whether by itself or in the aggregate, that is relatable to an identifiable natural person, and includes certain provisions that govern the collection and use of "sensitive personal data," which is defined as data that inherently places a data subject at risk of discriminatory practices. Sensitive personal data may include information on racial or ethnic origin, religious belief, political opinion, health and other information that allows unequivocal and persistent identification of the data subject, such as genetic data. Anonymized data is not considered personal data.

Extraterritorial Jurisdiction

The LGPD also is similar to the GDPR in its broad extraterritorial application. The Brazilian law applies to companies that: (1) carry out processing of personal data in Brazil; (2) collect personal data in Brazil; (3) process data related to natural persons located in Brazil; or (4) process personal data for the purpose of offering goods or services in Brazil.

Legal Basis for Data Processing

The LGPD provides 10 unique legal bases for processing personal data, which include when data processing is:

- done with the express consent of the data subject;

- necessary for compliance with a legal or regulatory obligation;

- necessary for the fulfillment of an agreement;

- necessary for the exercise of rights in a judicial, administrative or arbitration proceeding;

- necessary to protect life or physical integrity;

- necessary to protect health;

- necessary for the implementation of political policies (for processing by the government);

- necessary for purposes of credit protection;

- necessary to meet the legitimate interest of the data controller or third parties; or

- necessary for the performance of historical, scientific or statistical research.

With respect to consent of the data subject, the LGPD provides that consent may be waived where the data subject has "manifestly made public" his or her personal data. Where consent is not waived, a data subject's consent must be informed, revocable and provided for a specific purpose prior to the processing of the data subject’s personal data.

Data Protection Officers

The LGPD requires each data controller to appoint a data processing officer (DPO) whose responsibilities will include oversight of the organization's data processing activities and facilitation of data subject requests. This DPO role differs from the data protection officer role under the GDPR in that the LGPD DPO is an independent overseer of the company’s data protection activities and, as such, is not liable for such activities. The DPO may be an officer or an employee of the data controller, or of a third party provider, but in each case much perform his or her duties autonomously. In addition, unlike the GDPR, the LGPD DPO requirement applies to all controllers, without exceptions for small businesses or small-scale processors, although it is possible that the national data protection authority, once established, may identify certain exceptions to this requirement.

Data Protection Impact Assessment

The LGPD requires companies to generate a data protection impact assessment (DPIA) before undertaking personal data processing activities that may put data subjects at higher risk. The DPIA must document data processing activities that may create risks to data subjects, as well as the measures, safeguards and mitigation mechanisms the company has implemented to address those risks.

Data Transfer Restrictions

The LGPD imposes restrictions on cross-border transfers of personal data. Personal data may only be transferred to countries deemed to provide an adequate level of data protection, or pursuant to standard contractual clauses or other approved mechanisms. These adequacy decisions, standard contractual clauses and other transfer mechanisms will be issued by the national data protection authority when created.

Data Breach Notification

The LGPD requires companies to notify the national data protection authority within a “reasonable” time of any data breach. The period of time defined as reasonable is still to be determined by the data protection authority, though some experts believe that it is likely to mirror the GDPR’s 72-hour notice period given the overall similarities between the LGPD and the GDPR. Following receipt of the notice, the data protection authority will determine whether the data subjects must be notified and what mitigating steps must be taken by the company.

Penalties

The LGPD provides that the national data protection authority may impose sanctions for violation of the LGPD, including fines, or potentially even the total or partial prohibition of activities related to data processing. Fines may be up to 2 percent of the company's turnover in Brazil in its last fiscal year, limited in total to 50 million Brazilian reais per infraction (approximately US$12 million).

Key Takeaways

Companies that are already compliant with the GDPR will likely be in a position to comply with the LGPD without significant additional effort, as the two regulations include similar requirements for data processing, DPIAs and data transfers. Companies with data processing activities in Brazil and companies outside of Brazil that collect personal data from Brazilian residents should continue to monitor the implementation of the LGPD by Brazilian officials over the next 18 months so they can tailor their compliance programs accordingly.

French Data Protection Authority Issues Warning to Two Companies for Potential GDPR Violations

France’s data protection authority published a formal warning to two French companies regarding their geolocation data collection and retention practices. The warning provides some clarity on the GDPR’s consent and data retention standard.

In late July 2018, France’s data protection authority, the Commission Nationale de L'informatique et des Libertés (CNIL), published a formal warning to two companies — Teemo, Inc. (Teemo) and Fidzup SAS (Fidzup) — that allegedly collected and retained geolocation data in violation of the EU’s GDPR.2 The CNIL did not impose any fines on the companies, but stated that Teemo and Fidzup may be subject to penalties if they fail to obtain valid consent from data subjects and set an appropriate retention period for geolocation data within three months.

Teemo and Fidzup’s Personal Data Practices

Teemo and Fidzup provide software development kits (SDKs) that can be used in mobile applications to track the locations of users for purposes of sending targeted advertisements. Teemo’s SDK enables the collection of users’ geolocation data every five minutes. Fidzup’s SDK makes it possible to send targeted advertisements to users’ mobile phones whenever users are near a point-of-sale system installed by Fidzup.

Teemo and Fidzup maintained that they had received users’ consent to collect and process geolocation data. However, the CNIL performed audits and determined that the companies did not obtain users’ consent in a manner that would satisfy the GDPR’s requirements.

The CNIL found that users who downloaded mobile applications that incorporate Teemo’s SDK generally did not receive notice of Teemo’s geolocation data collection practices. When users downloaded a mobile application that included Fidzup’s SDK, the CNIL found that users generally did not receive any information about Fidzup’s purpose for collecting geolocation data or other information required under the GDPR. The CNIL also found that users could not download mobile applications without the SDKs and that users consented only to data processing by the mobile application provider and not for targeted advertising purposes.

Data Retention Under the GDPR

The CNIL’s warning to Teemo also provides some insight into how the CNIL views data retention practices under the GDPR. With some limited exceptions, the GDPR requires that personal data be kept in a form that permits identification of data subjects for no longer than is necessary for the purposes for which the personal data is processed. The GDPR offers little guidance on how that determination should be made. In its warning, the CNIL stated that by retaining geolocation data for 13 months, Teemo violated its obligations under the GDPR to define and respect a data retention period proportionate to the purpose of the processing.

The CNIL noted that the use of geolocation devices is particularly intrusive with regard to individual freedoms, given that such devices allow companies to follow users permanently and in real time, but did not expressly explain why 13 months is too long a period of time to retain geolocation data for targeted advertising purposes.

Key Takeaways

The warning to Teemo and Fidzup provides some early insight into how data protection authorities like the CNIL may approach GDPR enforcement with respect to the consent and data retention requirement. Companies that must comply with the GDPR should continue to monitor warnings and enforcement actions by EU data protection authorities to inform their data processing practices.

DHS Announces New Cybersecurity Center Aimed at Public-Private Coordination of Cyber Operations

The Department of Homeland Security (DHS) will create a National Risk Management Center that will focus on protecting critical infrastructure from cyberattacks.

At the National Cybersecurity Summit in New York City on July 31, 2018, the Department of Homeland Security announced the creation of the National Risk Management Center (Center), a new component of DHS’s cyber operations. The Center will work directly with federal government and private sector Skadden Partnersto protect infrastructure such as banking, energy and election systems from cyberattacks. The Center will seek to:

- identify and prioritize strategic risks to national critical functions;

- integrate government and industry activities on the development of risk management strategies; and

- synchronize operational risk management activities across industry and government.

The Center will be a continuation of existing efforts by DHS to protect critical national infrastructure and will work closely with the National Cybersecurity and Communications Integration Center (NCCIC), which was established in 2009. The NCCIC will remain DHS’s central hub for sharing threat indicators and providing incident response services. The Center will focus on understanding what threats are truly critical to private companies and the ways in which various public and private entities can communicate more effectively to reduce risk.

During her remarks at the summit, DHS Secretary Kirstjen Nielsen indicated that the creation of the Center was a response to the increasing threat of cyberattacks from foreign actors. Ms. Nielsen referenced Russian interference in the 2016 election and stated that cyberattacks posed a greater risk to national security than physical attacks.

DHS also announced the creation of a task force to be housed within the Center called the Information and Communications (ICT) Supply Chain Risk Management Task Force. The ICT Task Force will recommend solutions for identifying and managing risk within the global supply chain through policy initiatives and public-private partnerships.

At the summit, Secretary Nielsen compared combatting a cyber threats to solving a puzzle. The private sector brings to the table data about trends, implications and effects of an attack on businesses, while the public sector provides intelligence information that can be crucial to identifying the origin of the attack. The National Risk Management Center will focus on engaging both perspectives in hopes of bolstering critical infrastructure systems.

Key Takeaways

The success of the ITC Task Force, and the Center more broadly, may ultimately depend on buy-in from businesses in the private sector. While companies appear to be interested in receiving information regarding potential cyber threats from the government, some remain reluctant to share information with the government for fear of increased exposure to liability. The Center is an indication from the federal government that it recognizes the benefits to be gained from public-private partnerships.

Sixth Circuit Says Policyholder’s Social Engineering Loss Covered by Computer Fraud Policy

On the heels of a widely reported decision by the U.S. Court of Appeals for the Second Circuit holding that an insured was covered by a computer fraud policy for social engineering-related loss, the U.S. Court of Appeals for the Sixth Circuit recently issued a decision extending computer fraud coverage to losses incurred by a company as a result of a fraudulent email scam that wired over $800,000 to the fraudster’s account.

On July 13, 2018, the Sixth Circuit reversed a district court decision in favor of Michigan-based tool and die manufacturer, American Tooling Center, Inc. (ATC), concluding that its computer fraud insurer Travelers Casualty and Surety Company of America (Travelers) must cover an $834,000 loss suffered after ATC employees were tricked by an email spoofing scam that caused them to fraudulently wire company money to an imposter’s bank account.3

The Fraudulent Transfers and ATC’s Insurance Claim

The lawsuit, which we discussed in our December 2017 Privacy & Cybersecurity Update,4 arose in 2015, when a fraudster impersonating ATC’s Chinese manufacturing vendor, Shanghai YiFeng Automotive Die Manufacturers Co. Inc. (YiFeng), emailed ATC from an address closely resembling YiFeng’s and requested payment of over $800,000 in legitimate outstanding invoices to a new bank account that, unbeknownst to ATC, was controlled by the fraudster. After confirming that YiFeng was entitled to payment — but without verifying the new banking information — ATC wired payment to the fraudster-controlled bank account. By the time ATC detected the fraud, the money could not be retrieved.

ATC filed a claim under its Travelers crime policy, which provided computer fraud coverage for any “direct loss” that was “directly caused” by “Computer Fraud,” which was defined in part as “[t]he use of any computer to fraudulently cause a transfer.” Travelers denied the claim on the basis that ATC’s loss was not a direct loss that was directly caused by the use of a computer, and litigation ensued.

The District Court Denies Coverage

The U.S. District Court for the Eastern District of Michigan agreed with Travelers’ interpretation of the policy’s computer fraud coverage and granted summary judgment in Travelers’ favor, holding that ATC’s loss was not covered under the policy. The court reasoned that “[g]iven the intervening events between the receipt of the fraudulent emails and the (authorized) transfer of funds” — ATC’s verification that YiFeng was entitled to payment and initiation of the transfers without verifying bank account information — “it cannot be said that ATC suffered a ‘direct’ loss ‘directly caused’ by the use of any computer.” The court relied on Sixth Circuit precedent stating that “direct” is defined as “immediate” without any intervening events, as well as other district court decisions declining to extend computer fraud coverage to scenarios where an email is merely incidental to a fraudulent transfer.

The Sixth Circuit Reverses

A three-judge panel of the U.S. Court of Appeals for the Sixth Circuit reversed the district court’s decision, holding that ATC, not Travelers, was entitled to summary judgment. The panel rejected Travelers’ argument that the loss was not a “direct loss” as required under the policy and declined to follow the district court’s more narrow interpretation that “defie[d] common sense.” The mere fact that ATC legitimately owed $834,000 to YiFeng at the time it made the fraudulent transfer, and that ATC did not realize the fraud (or its loss) until later, did not bar ATC from “direct loss” coverage. The court concluded that there was no intervening event sufficient to break the required “direct” connection and that a direct loss occurred at the time ATC wired money to the fraudster, regardless of the fact that ATC did not find out about the fraud until later.

Similarly, the court rejected Travelers’ attempt to limit the meaning of “computer fraud” to “hacking and similar behaviors in which a nefarious party somehow gains access to and/or controls the insured’s computer.” The policy did not require the fraud to cause the computer’s actions and the Sixth Circuit panel refused to limit the definition in this way. Instead, the court held that the money transfer — prompted by the fraudster’s email spoofing — was covered by the meaning of “computer fraud” and that the fraud caused the direct loss, as required under the policy, since the ATC employees’ actions were all “induced by the fraudulent email.” The court declined to apply any coverage exclusions and ultimately reversed the district court’s decision, holding that Travelers was required to cover the loss.

On July 27, 2018, Travelers filed a petition for rehearing or rehearing en banc.

Key Takeaways

The Sixth Circuit’s decision is one of the latest decisions in what appears to be a growing trend in favor of broadly interpreting computer fraud coverage to extend to social engineering scams, even in the absence of a hacking incident or where the loss did not occur immediately after being tricked by the fraudster. Just last month, the Second Circuit similarly found that computer fraud coverage extended to a fraudulent transfer induced by email spoofing.5

Policyholders and insurers alike should keep an eye on the growing body of case law addressing coverage for social engineering loss, and insurance policies should be carefully drafted and reviewed to make sure that they properly reflect the parties’ intent.

Japan and EU Announce Adequacy Decision

Japan and the European Union recently announced an agreement to recognize each other’s data protection regimes as adequate. Once implemented, the agreement will permit the free flow of personal data between the two jurisdictions.

On July 17, 2018, Japan and the EU agreed to recognize each other’s data protection regimes as providing adequate protections for personal data. Once finalized, these "reciprocal adequacy" decisions will allow personal data to flow between Japan and the EU without being subject to additional safeguards. The mutual adequacy finding will enhance the benefits of the Japan-EU Economic Partnership Agreement (EPA), a free trade deal that was announced at the same time.

The European Commission is expected to formally adopt its adequacy decision on Japan in the fall of 2018. In connection with the decision, Japan agreed to implement additional safeguards to align with the EU's standards. Such additional safeguards have not yet been finalized, but will likely include stricter guidelines for the retransfer of personal data that originated from the European Economic Area (EEA) to a third country and additional limitations on the use of sensitive data. Japan also agreed to implement a new mechanism to allow European Economic Area residents to file complaints with Japan’s data protection authority if public authorities in Japan unlawfully access their data.

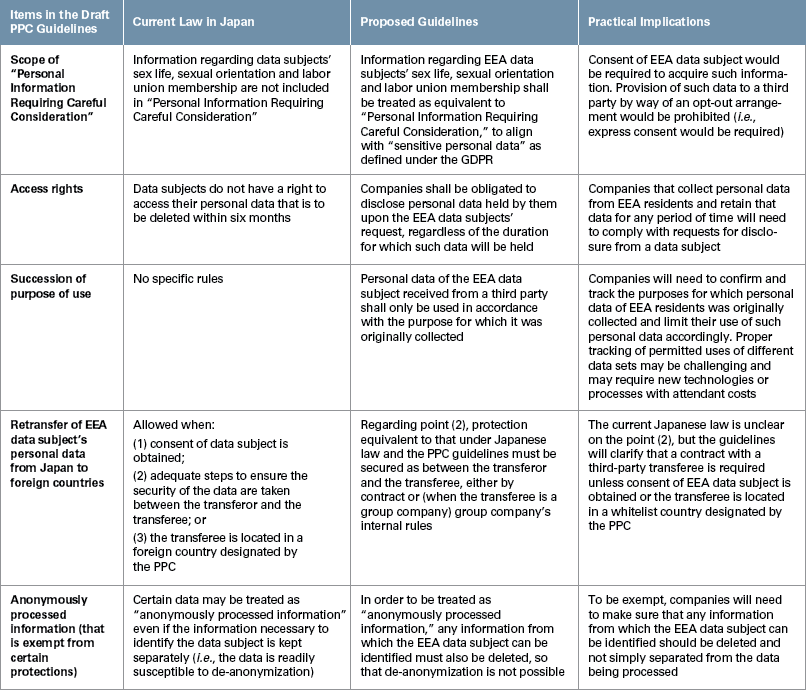

While the discussions between Japan and the EU were ongoing, Japan’s Personal Information Protection Commission (PPC) announced draft guidelines regarding the processing of personal data transferred from the EEA following the adequacy recognition.6 The draft guidelines were published for public comment in April 2018 and have not yet been finalized. According to the draft guidelines, five major substantive changes will be implemented with respect to the current Japanese regulations, as summarized in the chart below. The guidelines, once finalized, will apply only to personal data transferred from the EEA under the adequacy recognition.

Key Takeaways

Today, some companies that transfer personal data from the EEA to Japan do so pursuant to standard contractual clauses (SCC) published by the European Commission. Japanese companies using SCCs might assume they can readily terminate these agreements once the adequacy decision is formally adopted. However, companies should keep in mind that the adequacy decision only applies to EEA-Japan transfers, and SCCs between the EU and other jurisdictions will need to remain in place. Companies also should keep in mind that the EU is likely to issue an updated version of the SCC which complies with GDPR requirements, and which will need to replace current SCCs.

__________________

1 No official English translation of the LGPD has been provided.

2 A translated version of the CNIL’s warning can be found here.

3 The decision is Am. Tooling Ctr., Inc. v. Travelers Cas. & Sur. Co. of Am., 895 F.3d 455 (6th Cir. 2018).

4 See our December 2017 Privacy & Cybersecurity Update here.

5 The decision is Medidata Sols. Inc. v. Fed. Ins. Co., 729 F. App’x 117 (2d Cir. 2018), which is detailed in our July 2018 Privacy & Cybersecurity Update here.

6 " See Guidelines on the Law Concerning the Protection of Personal Information (Handling of Personal Data Transferred by Sufficiency Certification from within the EU)" (Japanese only.)

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.