View our full U.S. Capital Markets coverage from 2018 Insights.

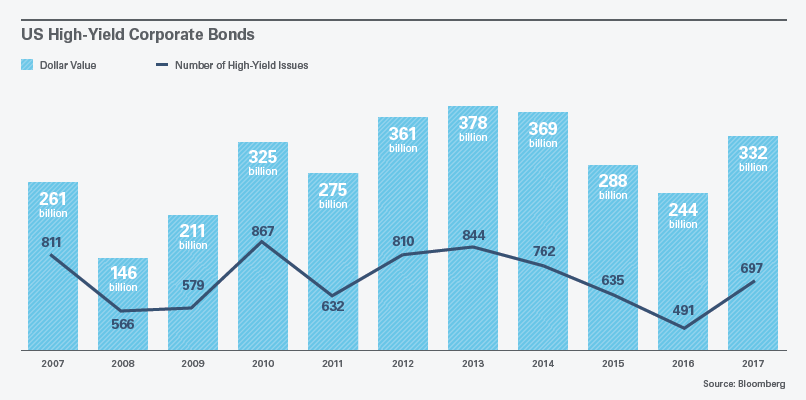

The U.S. high-yield debt market ended 2017 approximately 36 percent higher by volume and 42 percent higher by number of issuances than 2016, ending three consecutive years of decline but falling short of the record highs in 2012-14. U.S. high-yield bond issuances totaled $332 billion (697 issuances) in 2017 compared to $244 billion (491 issuances) in 2016.

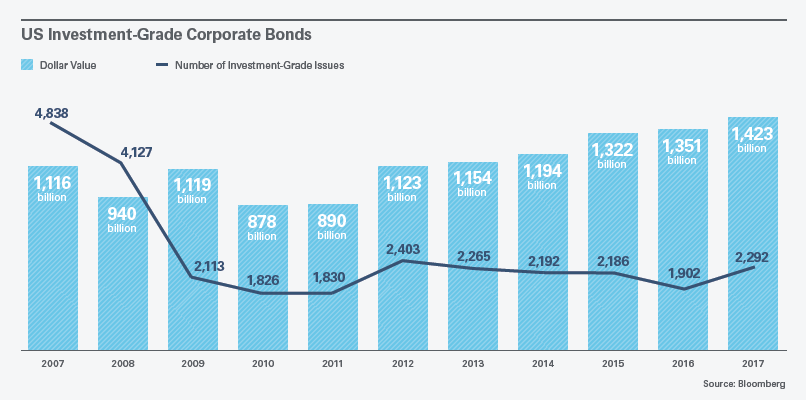

The U.S. investment-grade debt market had record volume of $1.42 trillion (2,292 issuances) in 2017, exceeding the previous record of $1.35 trillion (1,902 issuances) set in 2016 and marking the seventh consecutive year of dollar volume increase. AT&T was the largest issuer by volume, totaling $36 billion in 16 issuances, and in July 2017 also had the largest investment-grade transaction of the year at $22.5 billion in connection with its proposed acquisition of Time Warner. Refinancing activity continued to drive both high-yield and investment-grade volume, with M&A a distant second.

This memorandum is provided by Grand Park Law Group, A.P.C. LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.